A look at the recent National Accounts and what is going on with capital accumulation in Australia

The work of the critique of political economy is a thankless task: especially when reality comes and fucks up your theorising. Over the last year on this blog I have been trying to address a number of interrelated phenomena: the end of the mining boom as a symptom of the global recession, rising state debt and the difficulties this presents to facilitating social reproduction and the failure of the Government to implement ‘Plan A’ – the stimulation of the economy via infrastructure spending financed by asset sales and cuts to services. Then the Australian Bureau of Statistics comes along and publishes the National Accounts which detail higher than predicted growth rates for the last quarter: 0.7% trend and 0.6% seasonally adjusted. Calendar year growth is then up to 3.0% rather than the forecasted 2.5% (Scutt 2016).

This would indicated healthy growth rather than malfunctioning – and this is despite the continual end of the mining boom which was the engine that drove capital accumulation in Australia for the last two decades. And GDP growth is, I would attest, a mystified indicator of profitability. If the economy is growing it is because firms are investing; and they are investing because of a sufficient level of profit today and expectations of them tomorrow. So much for declining profitability then, so much for over-accumulation too, so much for looming crisis…

The Australian dollar shot back up and the economists of twitter celebrated:

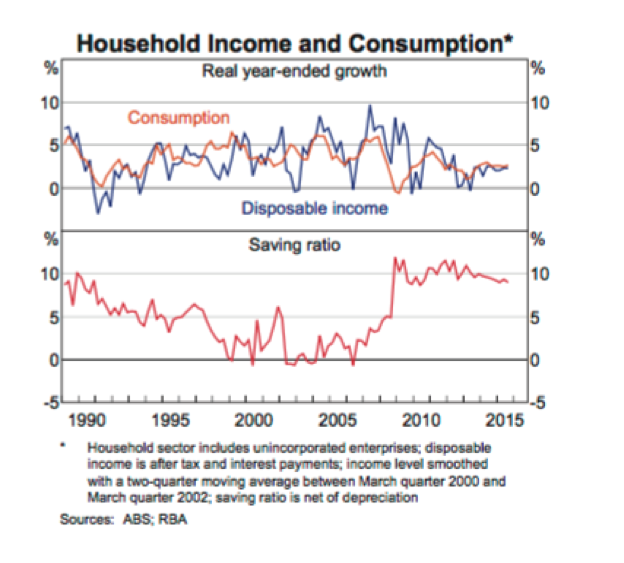

But the picture is more complicated. The spike in GDP growth doesn’t reflect a growth in profitability but rather a debt fuelled increase in aggregate effective demand. As the ABS summarised this growth is driven by household consumption and government spending and there has been a continual decline in business investment and major constructions: ‘The growth in expenditure was driven by a rise of 0.8 per cent in Household final consumption expenditure and a rise of 6.0 per cent in Public gross fixed capital formation. These were partially offset by a fall in private business investment (-3.3 per cent), driven by a fall in new engineering construction (-12.3 per cent) (Australian Bureau of Statistics 2016b).’ Military spending played an important role in this. The increase in consumer spending was driven by spending on: ‘services industries such as information, media and telecommunications (2.7%), retail trade (1.0%) and arts and recreation services (2.2%) (Scutt 2016).’

Thus declining business investment has been offset by an increase in state and consumer consumption fuelled by debt. (Nick at Revolts Now has written extensively of the financial ‘extend and pretend’ that underscores contemporary capitalism.)

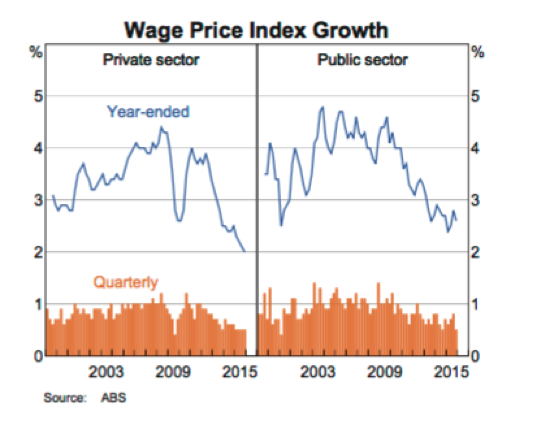

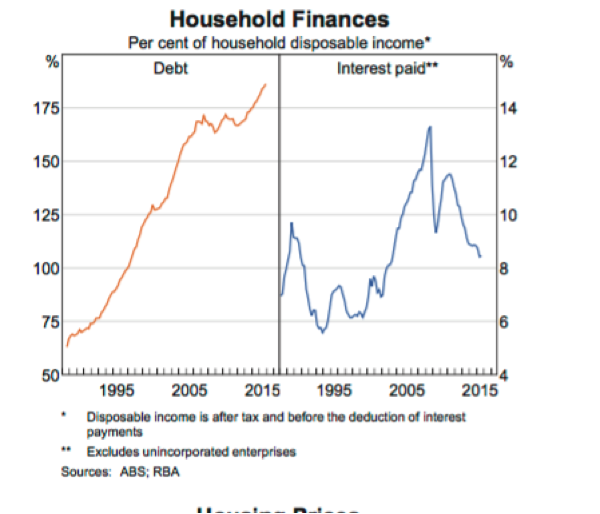

At this point let us remember that neither state spending nor consumer spending is due to an increase in income. Indeed wage growth has been declining, household debt has grown and the proportion of savings to debt has started to stumble. (Indeed the National Accounts showed ‘a fall of 0.6% in average earnings per employee’)(Australian Bureau of Statistics 2016a).

(Reserve Bank of Australia 2016, 10,6,5)

State revenues have also dropped and indebtedness has grown (Parliamentary Budget Office 2016, 1). In a world of continually increasing debt(McKinsey Global Institute 2015) it is debt again that has held up growth in Australia.

The communist journal Endnotes has written of the ‘holding pattern’ where both the class struggle and the economic crisis have become petrified (2013). The question is how long will the holding pattern hold? Is the holding pattern, or at least part of it, in Australia an increased volume of consumption funded by debt? (And houses as the workers’ capital…)

There are a number of things to consider here. State debt plays multiple roles: funds stimulative spending and social reproduction, functions as an asset and works to set prices in financial markets. These different roles come into contradiction with each other. Whilst the Right-wing rhetoric of a debt emergency is overblown increasing state debt can undermine its profitability as an asset and its functionality in setting prices; so too attempt to stabilise debt conflict with the state’s role in funding social reproduction and providing stimulus. (Of course perhaps Koukoulas’ prediction will be right and that this rise in growth will lead to a rise in revenue…)

The vast majority of household debt is made up mortgage debt as house prices continue to grow at rates that vastly outstrip all other measures. There is probably more than a little more hyperbole in the industry shills’ reports on looming crisis however there has been a vast explosion in the level of real estate debt and the bubble appears stretched (Verrender 2016).

Of course like state debt and household debts also functions as a tradeable assets, claims on future income, so called ‘fictitious capital’ (Marx 1991). Ownership of such assets has been generalised throughout the system as capitalism has become financialised (cf.Lapavitsas 2012, 2013, Marazzi 2011). To get some gauge of the size of this banks and other approved lending institutions held mortgage for residential properties to the tune of ‘$1.38 trillion as at 31 December 2015. This is an increase of $112.6 billion (8.9 per cent) on 31 December 2014’(Australian Prudential Regulation Authority (APRA) 2016).

Thus whilst many are popping champagne, and the Coalition government may be able to spin this to their advantage, this is not the end of the deep structural contradictions but rather their delay and their intensification. How long will the holding pattern hold? How large can household and state debt grow whilst business investment contracts? How long can household debt increase whilst wages stagnate? Debt is a claim on future labour, a claim on capital’s ability to exploit us tomorrow. This growth then is not an escape from the downward trajectory of global capitalism. Rather it is an expression of it as an attempt to escape from the contradictions of accumulation via debt and it is a form of escape that actually heightens the contradictions. As Holloway writes:

Crisis (and hence the materiality of anti-power) cannot be understood without discussing the role of the expansion of credit.

As profits fall, companies in difficulties seek to survive by borrowing money. Governments with economic and social problems seek to avoid confrontation with their populations by borrowing. Workers too seek to alleviate the effects of incipient crisis by borrowing. The increased demand for loans combines with the problems caused by insubordination in production to make it attractive for capitals to lend their money rather than to invest it in production. The onset of crisis gives rise to an expansion of credit and debt. Accumulation becomes more and more fictitious: the monetary representation of value becomes more and more detached from the value actually produced. Capitalism becomes more fictitious, more make-believe: workers make believe that our income is greater than it is; capitalists make believe that their businesses are profitable; banks make believe that the debtors are financially sound. All make believe that there is a greater production of surplus value than is actually the case.

All make believe that there is a greater subordination of labour, a greater subordination of life to capital than is really so. With the expansion of credit and debt, all our categories of thought become more fictitious, more make believe. In a peculiar, fetishised way, the expansion of credit expresses the explosive force of the subjunctive, the longing for a different society.

Classically, the expansion of credit reaches a point, however, at which, as a result of the avoidance of confrontation with insubordination, the relative decline in the surplus value produced makes it impossible to maintain the fiction. More and more debtors begin to default in their repayments, creditors (such as banks) start to collapse and the crisis is precipitated in its full intensity, with all the social confrontation that that involves. There is a massive destruction of fictitious capital and a massive destruction of the fictitious expectations and living standards of most people. (2002, 195)

What does it mean for us and our lives? There are I think two sides to the increase in consumer debt. On one hand our wages continue to stagnate and more of our spending is funded by credit – thus banks expropriate more of our income. Some of us are holding mortgages for houses whose value continues to grow but it is unclear how long they will stay at these prices; others of us are trapped in renting due to these very same house prices. This grind is applied whilst the social foundations remain unstable. Yet on the other hand increased debt can reflect out refusal to limit our horizons to what we can afford – and the stats seem to indicate an increased spending on pleasure and leisure. As Midnight Notes wrote about the US at the outbreak of the crisis:

The entrance to the credit system is no workers’ paradise, of course. Borrowing and the accompanying interest payments depress wages, sometimes quite substantially, and credit ties workers to the real estate and stock markets. However, it is an important achievement for workers to be able to “use someone else’s money” in order to have a home without worrying about rent increases and be paying the owners’ mortgage and his/her taxes, to have the desire (real or fancied) evoked by a commodity satisfied today, to have access to education that might make for higher wages in the future, and to have an automobile that makes a wider range of jobs and social contacts possible in the lonely landscape that life in the US often presents. This dangerous working class strategy hovered between using the credit system to share in collective wealth and debt peonage! (2009, 7)

What hasn’t emerged, at least on a large scale, is the other possible end to the holding pattern: the collective assertion of our own interests within-against-and beyond capitalism as a society and a form-of-life.

Australian Bureau of Statistics. 2016a. 5206.0 - Australian National Accounts: National Income, Expenditure and Product, Dec 2015 Main Features Income at Current Prices. Australian Bureau of Statistics [cited 2nd March 2016]. Available from http://www.abs.gov.au/ausstats/[email protected]/Latestproducts/5206.0Main Features4Dec 2015?opendocument&tabname=Summary&prodno=5206.0&issue=Dec 2015&num=&view=.

Australian Bureau of Statistics. 2016b. 5206.0 - Australian National Accounts: National Income, Expenditure and Product, Dec 2015 Media Release. Australian Bureau of Statistics [cited 2nd March 2016]. Available from http://www.abs.gov.au/ausstats/[email protected]/Latestproducts/5206.0Media Release1Dec 2015?opendocument&tabname=Summary&prodno=5206.0&issue=Dec 2015&num=&view=.

Australian Prudential Regulation Authority (APRA). 2016. Quarterly Authorised Deposit-Taking Institution Property Exposures December 2015 (Issued 23 February 2016).

Endnotes. 2013. The Holding Pattern the Ongoing Crisis and the Class Struggles of 2011-2013. (3 GENDER, RACE, CLASS AND OTHER MISFORTUNES), http://endnotes.org.uk/en/endnotes-the-holding-pattern.

Holloway, John. 2002. Change the World without Taking Power: The Meaning of Revolution Today. London: Pluto Press.

Lapavitsas, Costas. 2012. "Financialised Capitalism: Crisis and Financial Expropiation." In Financialization in Crisis, edited by Costas Lapavitsas, 15-50. Chicago, IL: Haymarket Books.

Lapavitsas, Costas. 2013. Profiting without Producing: How Finance Exploits Us All. London & New York: Verso.

Marazzi, Christian. 2011. The Violence of Financial Capitalism. New ed. Los Angeles: Semiotext(e).

Marx, Karl. 1991. Capital: A Critique of Political Economy. Translated by David Fernbach. Vol. 3. London: Penguin Books in association with New Left Review.

McKinsey Global Institute. 2015. Debt and (Not Much) Deleveraging: McKinsey & Company.

Midnight Notes Collective and Friends. 2009. Promissory Notes: From Crisis to Commons [cited 28th March 2010]. Available from http://midnightnotes.org/Promissory Notes.pdf.

Parliamentary Budget Office. 2016. National Fiscal Outlook as at 2015–16 Mid-Year Fiscal Updates Report No. 01/2016

.

Reserve Bank of Australia. 2016. The Australian Economy and Financial Markets Chart Pack March 2016. Reserve Bank of Australia [cited 2nd March 2016]. Available from http://www.rba.gov.au/chart-pack/pdf/chart-pack.pdf?v=2016-03-02-21-52-12.

Scutt, David. 2016. Australia's Economy Is Stronger Than Anyone Thought. Business Insider [cited 3rd March 2016]. Available from http://www.businessinsider.com.au/australia-gdp-q4-2015-economic-growth-2016-3.

Verrender, Ian. 2016. A Bubble Is Building That Could Shake Our Economy to Its Core. The Drum [cited 2nd March 2016]. Available from http://www.abc.net.au/news/2016-02-29/verrender-housing-bubble-is-building/7206678.

Comments

Sober Senses, Thanks for

Sober Senses,

Thanks for continuing with your blog on the Australian economic scene - useful information that adds to what is more often quoted from our knowledge of North America and Europe. I appreciate the tentative addition of some useful insights borrowed from the 'communiser' and 'autonomist marxist' milieu. Not sure about the theoretical underpinnings of the financialisation aspect of modern capitalism - still struggling a bit with the arguments around this on the 'Internationalist Perspective' discussion thread elsewhere on this site.

Hi Spikeymike. Thanks for the

Hi Spikeymike. Thanks for the feedback and I'll chase down that threat on IP to read. I haven't paid their work near enough attention as I would like.

I guess I am fairly theoretically agnostic these days and draw on a lot of mutualyl contradictory theory - for example here I site Lapavitsas and Marrazi though I don't think the two's theories of finance would fit together. Rather writing for an Australian context I often want to a) give a broad justification for my point b) gesture to a wider literature out there to attempt to lift the level of debate in Australia. (Jesus that sounds pretentious.....)

cheers

Dave