Long read on what is happening with wages in Australia and why arguments that say increasing productivity will make us richer are wrong.

Wage growth in Australia is in a pitiful state. Both the frequency and size of wage growth is at historic lows (Bishop and Cassidy 2017). The recent rise in inflation means that not only are wages growing at a lower rate than any time since the Second World War, they are now growing slower than the rate of inflation. This means that real wage growth is now negative.

(Fig. 1 & 2 Bagshaw 2017)

This is a grim situation for the vast mass of people as it means the effective stalling or decline in the material conditions of our lives. It also presents Australian capitalism with several complex and interlocking problems. First, while the overall share of national income shifted in capital’s favour throughout the late neoliberal period of the mining boom, the secret to social cohesion was the growth in the majority of households’ wealth as consumables became cheaper and incomes grew, as wages rose alongside the amount of people working and total hours worked. The disintegration of this deal poses the spectre of social and political disturbances, framed as ‘populism’ by spruikers of the political class. However, low wage growth threatens not just political stability in Australia, but the process of capital accumulation and the reproduction of capitalist society more directly.

While individual firms may wish to pay their workers with air, capitalism as a whole needs wages to be high enough to ensure there is enough money in people’s pockets and that people are willing to spend it. This is often called ‘aggregate effective demand’. The reproduction of capitalism requires that a sufficiently high level of commodities is sold to generate a profit that can be reinvested and so on. Declining wage growth directly threatens the profitability of retail businesses, and because retail businesses are part of a broader chain of capitalist firms, the health of the economy more broadly. The Reserve Bank of Australia are particularly worried about the impact the combination of low wage growth and high indebtedness could have on spending and Australian capitalism (Lowe 2017).

Another specific problem is that even as wage growth has stalled, house prices have soared, facilitated by the continual rise in household debt. Increasingly thinkers for capital are concerned that the capacity to pay this debt is faltering and that the prices of real estate assets are shaky. There is growing concern that a collapse in residential prices could hit the banks and destabilise the financial architecture of capitalism in Australia (Shapiro and Greber 2017) . Thus, the Australian Prudential Regulatory Authority has acted to reduce the percentage of interest-only loans that can be offered in an attempt to ‘address risks that continue to build within the mortgage lending market’ whilst ‘balancing the need to continue to moderate new investor lending with the increasing supply of newly completed construction which must be absorbed in the year ahead’(2017). APRA aims to slow down the risk of rising mortgage debt whilst simultaneously allowing the housing market to continue functioning. Is it likely that such activity can both reduce the exposure of the banks whilst facilitating the continual accumulation of capital?

Low wage growth, continued housing price growth and high household debt all take place in the context of low investment in Australia. This is despite a rise in profits and in the context of a global situation that the World Bank describes as a ‘fragile recovery’ (Potter 2017, World Bank Group 2017).

This problem cannot be solved - for capital - just by raising wages. This would shrink profits and thus, accumulation.[i] Rather the challenge for thinkers for capital is to work out a way to increase aggregate effective demand and profits: to increase incomes in a way that ensures the continual accumulation of capital and thus the enlarged reproduction of the capital-relation. For us (meaning both those of us with nothing but our labour-power to sell and self-declared antagonists to capital) the problem is radically different – to work out ways of asserting our interests for a good life irrespective of capital’s requirements and to do this inside-against-and-beyond the whole totality of capitalism as a society and a way of living.

Are growth of productive capital and rise of wages really so inseparably connected as the bourgeois economists maintain? We must not take their word for it. We must not even believe them when they say that the fatter capital is, the better its slave will be fed. (Marx 1978, 41-42)

Two strategies for wages and for capital

A week before the return of parliament for 2017, Malcom Turnbull and Bill Shorten addressed the National Press Club. Should we care? I have been thinking about the role of these speeches. What functions do they serve? Shown at 12.30 AEST on a weekday, they are certainly not aimed at a wide audience. Rather they are interventions on the level of the political class from within the political class. This is something Shorten (2017) was fairly clear about. He says: ‘I say ‘us’ – because, virtually everyone in this room is considered part of the problem, part of the political class’. In this sense, these speeches tell us something about the role of politics in the functioning of the state and the role of both in the reproduction of Australian society as a capitalist society. Thus, for us, they are only worth our attention to the extent that they give us insights into how our enemies are formulating strategies, what these strategies are and what both tells us about the specific concrete situation we inhabit.

In the current conditions of political meltdown and malfunction, it is hard to be certain about what any political party’s policies actually are. The federal government has defied the wishes of its supporters and disappointed the nightmares of its opponents by being largely ineffective at doing almost anything. The government’s original strategy of stimulating the economy via massive investment in infrastructure funded by state level privatisations and cuts to social spending failed. It withered, decayed and decomposed due to opposition in the Senate, the 2015 Queensland election and popular opposition to the East–West Link in Melbourne, leading to the fall of another Liberal State government. Since this strategy has fallen through, they have been adrift. The current Turnbull–Morrison government is beset by an insurgent right wing inside and outside the party, a lack of anything that could constitute a popular mandate, and face a hostile Senate that makes passing any major legislation seemingly impossible. The attempt to ram through stalled legislation in the form of omnibus bills failed and the cost of this failure to the budget continues to ramp up (Parliamentary Budget Office 2017). Every day seems to confirm the anti-politics thesis: that during neoliberalism politics became disconnected from the any social base and now political formations lack social power and are in a condition of atrophy and spasm (Humphrys and Tietze 2013, Tietze and Humphrys 2015).

The PM and the Opposition Leader both share a set of concerns: the increasingly dismal level of economic growth, the antipathy of the people towards politicians, the rise of populism globally, and the mounting cost of housing (among others). The two political opponents did frame their approaches different. Shorten tried to resurrect a form of Aussie social democratic class language; Turnbull styled himself as the post-ideological technocrat concerned with what ‘works’; Shorten fostered the image of a leader attending popular town meetings where ordinary people could make suggestions. Turnbull spoke of the impact of rising energy costs; Shorten adopted the old-style Australian Labor Party (ALP) nationalist opposition to 457 visas.

Two clear paths being proposed: the Government is arguing for tax cuts, while the Opposition is arguing for increasing training as the basis for laying the ground work for developing high value industry. Both make the same claim that either cutting taxes or increasing training will lead to economic growth and rising wages. Despite appearing as opposing approaches to solving the same set of problems, both arguments share a neoclassical world view; a world view that since it fails to understand the realities of the capitalist mode of production can’t produce viable understandings or solutions to the challenges of our historical condition.

The core of Turnbull’s (2017) argument is as follows:

Now when we talk about opportunity and jobs, lower taxes - in particular lower business taxes - are of critical importance.

87 per cent of the jobs in Australia are in the private sector. You don't get more jobs, higher wages or more hours by taxing the businesses that employ Australians more.

Without a competitive business tax rate, Australia will be less able to attract investment. And without investment, there will be fewer jobs.

The reality is that we are part of an intensely competitive global economy, and other countries have been cutting - and will continue to cut - their company tax rates. We cannot afford to get left behind and let Australian jobs go offshore.

Cutting business tax will create more opportunities, overwhelmingly benefitting small businesses, family-owned businesses that are the lifeblood of so many communities in our regions and in our cities.

We will begin by cutting company tax, to 27.5 per cent, for small and medium businesses with a turnover of less than $10 million.

That means a small Australian business will be able to invest more, hire more and increase wages.

Years of research - much of it commissioned by the previous Labor Government - has revealed a less obvious but very important fact: company tax is overwhelmingly a tax on workers and their salaries.

If we had a 25 per cent business tax rate today, full time workers on average weekly earnings would have an extra $750 in their pockets each and every year. Now none of this will come as a surprise to Labor who supported – in the past – but now oppose, a cut to business tax.

These tax cuts were recently passed, in a modified form, for companies earning up to $50 million (Massola 2017).

Let us start by giving the devil his due. When someone says that tax cuts overseas make Australia a less attractive place to invest in if it does not also lower taxes, this is, all things being equal, generally true.[ii] Depending on capital’s mobility and the ability of different states to provide the security of property rights, trained labour, etc., capital is compelled to go where it will make the highest profits. Sure, there is no point for a mining company to leave a country where there are mineral deposits and high taxes for one where there are low taxes, but nothing to mine. However, if the tax rate was the only difference it would act in a strong way to determine the location of investment.

What about Turnbull’s key selling point – that cutting taxes to capital means an increase in workers’ wages, as firms will have more income and will use this income to invest in their operations? This investment, it is claimed, will increase the productivity of workers and with the increase in productivity, we will see a rise in wages. The argument rests on a 2014 paper from Treasury entitled The Incidence Of Company Tax In Australia by Rimmer, Smith, and Wende (2014). The paper models three scenarios (one of perfect competition, one where there are economic rents and one where there is economic rents and imperfect capital mobility) through a general equilibrium model (also known as a made up magic land that bares little to no relationship to the actual economy). The paper analyses who would benefit from a 1% tax cut to companies and declares that households would get 2/3rds of the benefit, mainly through higher wages. It states: ‘The modelling also suggests that Australian workers benefit from the company income tax cut in the long-run. The productivity of labour increases with the increase in the size of the capital stock and this flows through to an increase in after tax real wages…’ To rephrase: if companies paid less tax they would spend more on machinery and technology, as the proportion of machinery and technology in relation to workers rise, workers become more productive and since they are more productive they get higher wages. This is of course, bullshit.

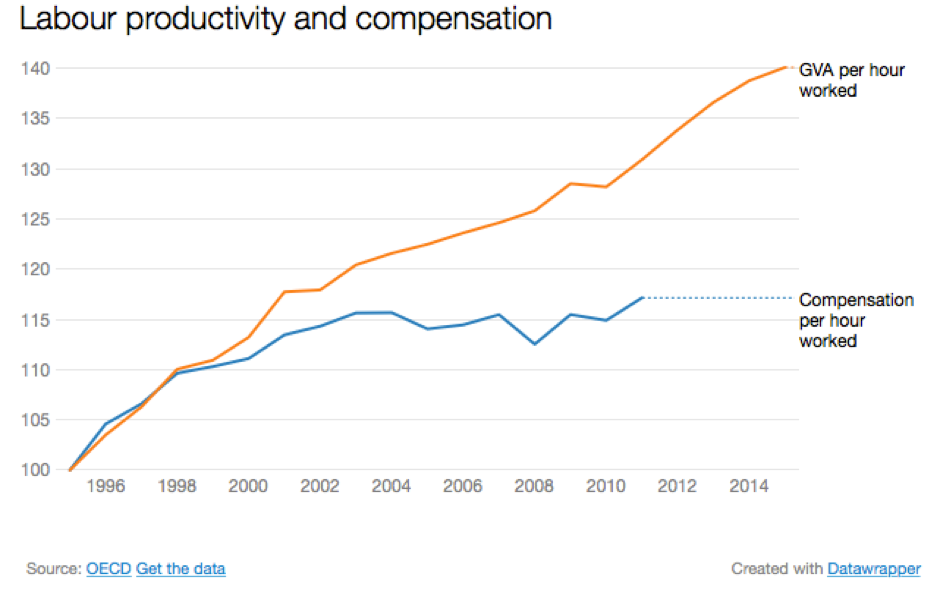

Theoretically, companies that pay less in tax could then increase wages, and companies that increase productivity may be able to increase their market share and profits and could then increase wages. However, there are two glaring problems with this argument. First, it is not at all clear that if you cut a firm’s taxes that it will take its increased returns and invest them in its already existing activities. In the capitalist mode of production, the rationale driving firms is the creation of profit and the behaviour of firms is conditioned by the ‘coercive laws of competition’ (Marx 1990, 433). Thus, firms will be compelled to use funds in the most profitable way. This of course may well involve taking this money and investing it elsewhere. As a general tendency since the late 1970s, more and more capital has been invested into financial activities, not production (Lapavitsas 2013, Marazzi 2011). Second, it is not actually a reality in any way that increasing the productivity of a firm leads to a rise in the wages of its employees(Jericho 2017a).

However, interestingly, the idea that wages – both their actual size and the size of their share of national income - are determined at least in part by productivity (that other oft quoted major dynamic is supply and demand), is a position that is shared by almost all the political mainstream, including the ALP.

The ALP once sold the beautiful lie that socialism could be achieved through reform via parliament. The lie has changed. Now the ALP tell us that ‘capitalism with a human face’ is possible (Žižek 2000, 63). The rationale goes something like this: the problems of our society are largely due to the bad ideas and personal failings of the right-wing side of politics and its supporters (heads of mining companies, conservative think tanks, etc.). As such, a viable and desirable form of capitalism is possible through good ideas, good people and good policy. As Wayne Swan (2016) says in his hagiography of the Hawke-Keating government: ‘Australian Laborism showed that when the circumstances are right, policies that liberalise an economy, delivered in conjunction with policies that taper the excesses of market capitalism, can provide economic benefits for working Australians.’

Take this opinion piece in The Guardian from Andrew Leigh, the Shadow Assistant Treasurer and member for Fraser entitled Yes, we need to improve productivity, but not by slashing penalty rates . Written well before the Fair Work Commissions decision to do just that it has become pressingly relevant. Leigh unlike the nasty Coalition who wants to cut conditions suggests a wide ranging and progressive alternative:

But what about investing in schools, universities and Tafe so that tomorrow’s workers are more skilled? Striking global trade deals that help reduce barriers to trade right across our trading partners? Improving infrastructure so that companies can get their products from the ship to the local shops more quickly? How about tackling market monopolies that let big companies get lazy in the absence of competition? Or providing superfast broadband so the next killer app can be invented here? These all advance ends that progressives care deeply about and boost productivity in the process. They reflect the principle that progressive productivity growth can be driven by smart investment, not brutal cuts.

Sounds good – pity it is (also) bullshit.

Leigh writes: ‘Income per capita grows when productivity improves because companies are able to generate more output with fewer resources. So long as those firms face a competitive product market, they will then invest those savings into expanding their operations, or paying higher wages to their more productive workers. Either way, the benefits ripple out through the economy.’ Leigh, and the ALP make exactly the same argument that Turnbull and the Coalition do: that productivity is key to rising wages.

There is something about this argument that seems intuitively true. If you can make more with less then surely you have more wealth. If I can make more hot-cross buns from a certain amount of ingredients, technology and my labour and time, am I not richer? I have more buns! Is it not the same for workers in a company – the more productive they are, the richer they should be?

The mainstream argument rests on a key facet of neoclassical thought: marginal productivity. Marginal productivity holds that the return to a factor of production, such as labour, is determined by what it adds to the process of production. The relationship between capital and labour is then consecrated in the production function. The division of income between capital and labour is similarly determined by their respective productivity. If you were to remove that worker or that piece of capital, then the drop in output would tell us what their fair share is. This production function was theoretically blown out of the water when Joan Robinson and the post-Keynesians asked what on earth a non-monetary measure for a unit of capital was – a key assumption of this theory – and its defenders came up short. However it has continued as dogma to this day (Harcourt 2015). The implication of the production function is that, given a standard set of assumptions, what workers get and what capital gets is essentially fair as reflects the worth of their contribution.

Such an approach argues that a world where the returns to factors of production – wages for labour and profits for capital – are determined by the interplay of supply and demand and marginal productivity under the conditions of the free market is actually the best of all possible worlds. Workers get a fair and a just share determined by their efforts, the relationship between employer and employee is one of mutual benefit where neither’s wealth was opposed to the other. The division of wealth in society, where childcare workers make less than PR executives, may be perhaps regrettable, but is inescapable – a product of a logical and essentially regular and harmonious mechanism. Some get more than others, some are rich and some poor, but this is just, efficient and rational. Such a world expresses a natural order.

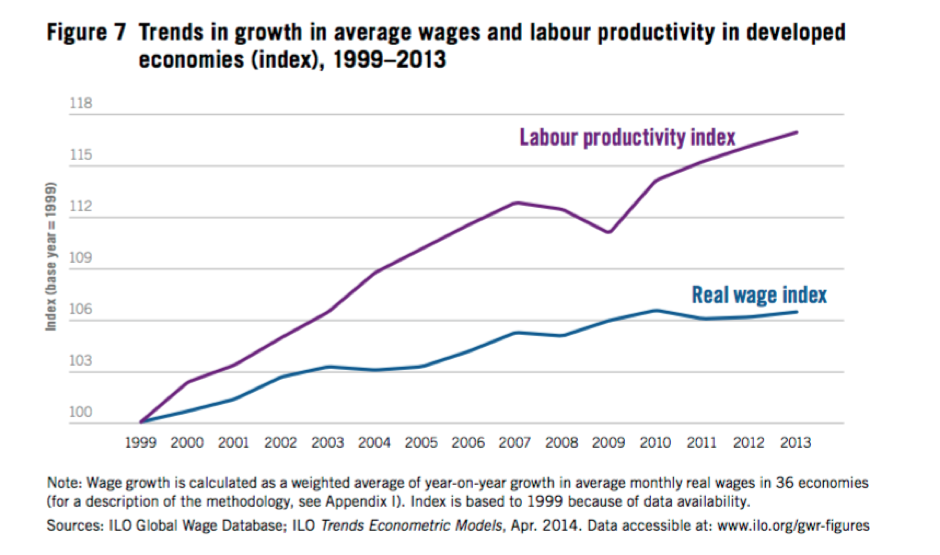

Where this theory clearly falls down is that increases in productivity do not automatically translate into rising wages. RBA chart pack after chart pack now shows wage growth is stalling while the ratio of capital to labour continues to increase (for example Reserve Bank of Australia 2017, 10). Most of us see this every day in our workplaces. Not only does any increase in the effort of our labour often go unremarked and unrewarded, increased productivity and efficiency often means cuts to staffing – the attempt to do the same or more with less. This is due, in part, to the nature of wage-labour and the structurally antagonistic relationship between workers and capital. In fact, for the last two decades, productivity growth has significantly outstripped wage growth in the developed world – though in Australia this picture has been more complex due to a rise in wages during the mining boom.

(Fig. 3 Source: Global Wage Report 2014/15: Wages and income inequality 2015)

(Fig. 4 Jericho 2017a)

(Fig. 4 Jericho 2017a)

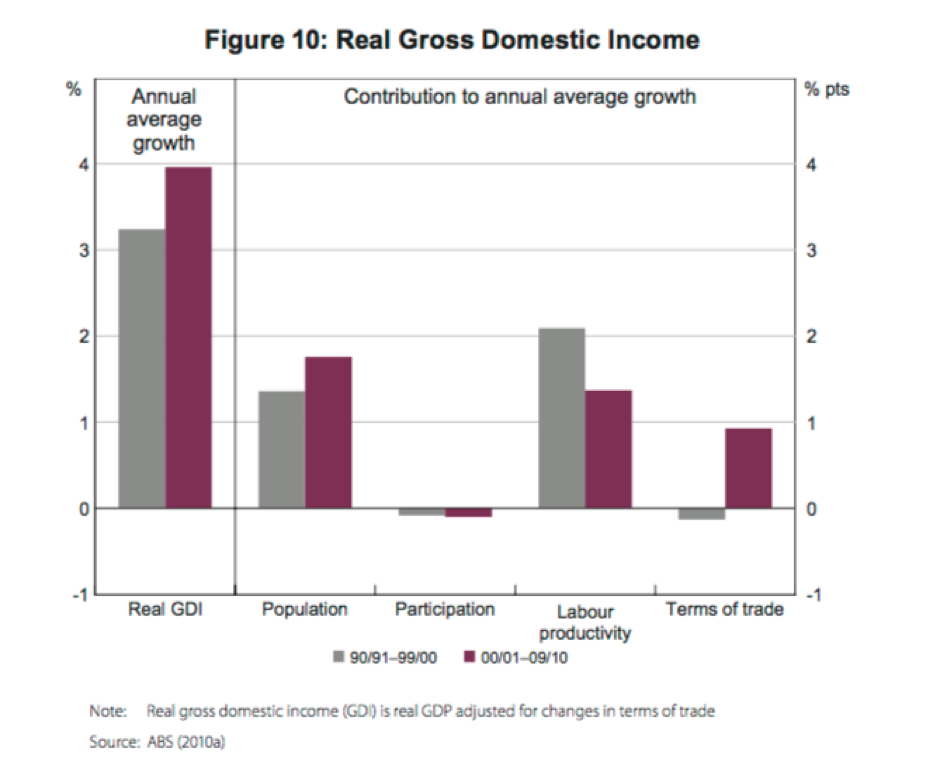

One issue leading to confusion about the relationship of productivity to wages is that national measure of productivity diverges from our common understanding of what productivity is. Productivity is normally thought of as the relationship between the volume of inputs to that of outputs. However, national labour productivity statistics are constructed through averaging the relationship of total hours worked to total output measured in monetary terms for the 16 ‘market’ industries. For multifactor productivity, both inputs and outputs are measured in monetary terms (Gordon, Zhao, and Gretton 2015). A single measure of wages also ignores inequality in wages growth. Wages in Australia have generally grown over the last few decades, but so too has inequality in the level of this growth (Greenville, Pobke, and Rogers 2013). Thus, simply placing a graph showing productivity next to one showing wages growth obfuscates the real picture. However, if you did do this it does reveal some insights. We do not see a clear correspondence between productivity growth and wages. As the erstwhile paladin for capital Saul Eslake is forced to admit, the 1990s saw higher productivity growth than the 2000s, but in the 2000s wages grew more than in the 1990s (Seen here in relation to Gross Domestic Income – not exactly wages, but close enough).

(Fig. 5 Eslake 2011, 244)

(Fig. 5 Eslake 2011, 244)

Eslake’s explanation for this reveals what is the real concern for neoclassical economists. For capitalism to remain viable it is crucial that any growth in wages is offset by growth in the rate of profit. That is, the exploitation of labour must keep apace or indeed exceed any increase in remuneration. Eslake’s concern takes the form of a haunting: a worry about a return to the end of Fordism when workers struggles threw the whole system into disarray (see Caffentzis 2013, Holloway 1996, Montano 1992). Indeed Eslake writes, ‘There is a very strong echo here of Australia’s experience during the 1950s, 1960s and early 1970s’ (2011, 245). The hope for thinkers for capital is that productivity growth will ensure rising wages and rising profits and lock in political and economic stability. Even the dull language of the dismal science can only do so much to hide the main cause of concern: a working class that refuses to work at the rate, duration and intensity desired by capital.

Here we see the truth – productivity is a stand-in for surplus-value.[iii] The push for productivity is a push to increase the rate of surplus-value, by reducing the proportion of the working day that is necessary to produce goods and services that recoup the costs of wages (Marx 1990, 340-44). Wages can grow only if exploitation grows more. In this sense productivity does matter. It is in fact crucial, for capital. Each firm attempts to increase its profits – the difference between costs and sales – and increasing productivity is one way of doing this. A firm that the can produce a product cheaper and/or in greater volume than its value, and still sell at this value or thereabouts, receives a greater share of profit (this is relative surplus-value) (Marx 1990). Through the coercive laws of competition, and due to the constant struggle of capital with labour, a system-wide dynamic pushing for higher productivity is created. On the level of capitalism as a system the increase in productivity, especially of consumer goods, works to reduce the cost of labour and labour’s share of income.

By raising the productivity of the useful labour that produces the means of subsistence (or the inputs into their production), capital reduces the value of the commodities the working class receives to reproduce itself. If the values of the means of subsistence fall, then capital can pay workers less value than before and yet they will receive as many (or even more!) use-values. If the amount of variable capital that must be invested in labour-power can be reduced in this fashion, at the same time that the total amount of work and hence of value remains the same, then the relative share of value which capital receives as a surplus will rise. This is the relative-surplus-value strategy (Cleaver 2000, 133).

The drop in the price of consumer goods, especially by the shift of production to South East Asia, to be produced in conditions of lower labour costs, partly explains why the wealth of workers in Australia grew even as their share of income dropped – coupled with the increase in labour force participation, hours worked, actual wage rises and increased access to credit and financial markets (Parham 2013).

As these profits are reinvested as capital the increased productivity of the worker by increasing the size of capital increases the density and size of the world we are estranged from and within. ‘The capital-relation presupposes a complete separation between the workers and the ownership of the conditions for the realization of their labour. As soon as capitalist production stands on its own feet, it not only maintains this separation, but reproduces it on a constantly extending scale’ (Marx 1990, 874). And this also means that it increases the contradictions and antagonisms within capitalist society which exist as ‘so many mines to explode it’(Marx 1993, 159).

This leaves us in a better position to start understanding what determines the size of wages – class struggle. In Part 2, I will attempt to explore how wages are a barometer of class power and are determined by the interaction of struggle in the broadest sense with the dynamics of capital accumulation. For the latter itself is also class struggle that takes a fetishised form. From here, I will paint with a broad brushstroke how this manifests in Australia.

This blog post was painstakingly and carefully edited by Alison Pennington. This transformed it from the barely legible to what it is now. Critical comments Ali raised have been incorporate. I am deeply thankful for this help. Responsibility for all errors and idiocies is mine

International Labour Organisation. 2015. Global Wage Report 2014/15: Wages and income inequality. Geneva: ILO: International Labour Office.

Australian Prudential Regulatory Authority. 2017. APRA announces further measures to reinforce sound residential mortgage lending practices. Australian Prudential Regulatory Authority [cited 24th June 2017]. Available from http://www.apra.gov.au/MediaReleases/Pages/17_11.aspx.

Bagshaw, Eryk. 2017. Wage growth set to stall at all-time lo. Brisbane Times [cited 17th May 2017]. Available from http://www.brisbanetimes.com.au/federal-politics/political-news/wage-growth-set-to-stall-at-alltime-low-20170516-gw5uxh.html.

Bishop, James, and Natasha Cassidy. 2017. "Insights into Low Wage Growth in Australia." RBA Bulletin (March 2017):13-20.

Caffentzis, George. 2013. In Letters of Blood and Fire: Work, Machines and the Crisis of Capitalism. Oakland, CA: PM Press.

Cleaver, Harry. 2000. Reading Capital Politically. Leeds & Edinburgh: Anti/Theses & AK Press.

Eslake, Saul. 2011. Productivity: The Lost Decade. Reserve Bank of Australia [cited September 28th 2015]. Available from http://www.rba.gov.au/publications/confs/2011/pdf/eslake.pdf.

Gordon, Jenny, Shiji Zhao, and Paul Gretton. 2015. On productivity: concepts and measurement: Productivity Commission Staff Research Note, Canberra, February.

Greenville, Jared, Clinton Pobke, and Nikki Rogers. 2013. Trends in the Distribution of Income in Australia. Canberra: Productivity Commission Staff Working Paper.

Harcourt, G. C. 2015. "On the Cambridge, England, Critique of the Marginal Productivity Theory of Distribution." Review of Radical Political Economics no. 47 (2):243-55.

Holloway, John. 1996. "The Abyss Opens: The Rise and Fall of Keynesianism." In Global Capital, Nation State and the Politics of Money, edited by John Holloway and Werner Bonefeld, 7-34. Houndmills, Basingstoke, Hampshire and London: Palgrave MacMillian.

Humphrys, Elizabeth. 2015. The Corporatist Origins of Neoliberalism: Australia’s Accord, the Labour Movement and the Neoliberal Project. PhD thesis, Faculty of Arts and Social Sciences School of Social and Political Sciences Department of Political Economy, University of Sydney.

Humphrys, Elizabeth, and Tad Tietze. 2013. Anti-politics: Elephant in the room. Anti-politics: Elephant in the room [cited 7th April 2016]. Available from http://left-flank.org/2013/10/31/anti-politics-elephant-room/.

Jericho, Greg. 2017a. Australians aren't being paid for their productivity. Get set for an industrial relations war. The Guardian [cited 11th June 2011]. Available from https://www.theguardian.com/business/grogonomics/2017/may/23/australians-arent-being-paid-for-their-productivity-get-set-for-an-industrial-relations-war.

Jericho, Greg. 2017b. Will company tax cuts really boost jobs or investment? The evidence is thin. The Guardian [cited 3rd July 2017]. Available from https://www.theguardian.com/business/grogonomics/2017/feb/14/the-governments-company-tax-cut-policy-has-two-major-problems.

Kouparitsas, Michael, Dinar Prihardini, and Alexander Beames. 2016. Analysis Of The Long Term Effects Of A Company Tax Cut. Treasury Working Paper, http://www.treasury.gov.au/~/media/Treasury/Publications and Media/Publications/2016/TWP2/Downloads/PDF/Treasury-Working-Paper-2016-02.ashx.

Lapavitsas, Costas. 2013. Profiting Without Producing: How finance exploits us all. London & New York: Verso.

Lowe, Philip. 2017. Household Debt, Housing Prices and Resilience. Reserve Bank of Australia [cited 9th May 2017]. Available from https://www.rba.gov.au/speeches/2017/sp-gov-2017-05-04.html.

Marazzi, Christian. 2011. The Violence of Financial Capitalism. New ed. Los Angeles: Semiotext(e).

Marx, Karl. 1978. Wage Labour and Capital. Peking: Foreign Languages Press.

Marx, Karl. 1990. Capital: A Critique of Political Economy. Translated by Ben Fowkes. Vol. 1. London: Penguin Classics.

Marx, Karl. 1993. Grundrisse: Foundation of the Critique of Political Economy (Rough Draft). London: Penguin Books.

Massola, James. 2017. Malcolm Turnbull's company tax cut rises from $50 billion to $65.4 billion. The Sydney Morning Herald [cited 7th June 2017]. Available from http://www.smh.com.au/federal-politics/political-news/malcolm-turnbulls-company-tax-cut-rises-from-50-billion-to-654-billion-20170511-gw2ksm.html.

Minifie, Jim. 2017. Business investment is weak, but an unfunded company tax cut won’t fix it. The Conversation [cited 3rd July 2017]. Available from https://theconversation.com/business-investment-is-weak-but-an-unfunded-company-tax-cut-wont-fix-it-73655.

Montano, Mario. 1992. "Notes on the International Crisis." In Midnight Oil: Work, Energy, War 1973-1992, edited by Midnight Notes Collective, 115-42. Brooklyn, NY: Autonomedia.

Parham, D. 2013. Labour's Share of Growth in Income and Prosperity. Canberra: Visiting Researcher Paper, Productivity Commission.

Parliamentary Budget Office. 2017. Unlegislated measures carried forward in the budget estimates—

February 2017 update.

Potter, Michael. 2017. Why we can't be sure if we're in a housing price bubble. Business Insider Australia [cited 11th January 2017]. Available from http://www.businessinsider.com.au/why-we-cant-be-sure-if-were-in-a-housing-price-bubble-2017-1.

Reserve Bank of Australia. 2017. The Australian Economy and Financial Markets Chart Pack May 2017 [cited 10th May 2017]. Available from https://www.rba.gov.au/chart-pack/pdf/chart-pack.pdf?v=2017-05-10-21-46-36.

Rimmer, Xavier, Jazmine Smith, and Sebastian Wende. 2014. The incidence of company tax in Australia. Economic Roundup Issue 1, 2014, http://www.treasury.gov.au/PublicationsAndMedia/Publications/2014/Economic-Roundup-Issue-1.

Shapiro, Jonathan, and Jacob Greber. 2017. "Interest-only loans our 'sub-prime'." The Australian Financial Review, Monday 22 May 2017, 1,6.

Shorten, Bill. 2017. Address To The National Press Club - Canberra - Tuesday, 31 January 2017. billshorten.com.au [cited 27th February 2017]. Available from http://www.billshorten.com.au/address_to_the_national_press_club_canberra_tuesday_31_january_2017.

Silk, Marty. 2017. Profits soar as wages, investment flounder. news.com.au [cited 3rd July 2017]. Available from http://www.news.com.au/finance/business/breaking-news/company-profits-rose-201-in-dec-qtr/news-story/405bc0e35758ba193f8a4558345173bd.

Smith-Gander, Diane. 2017. Tax cuts for stronger investment, higher wages, more jobs. CEDA: Committee for the Economic Development of Australia [cited 3rd July 2017]. Available from http://www.ceda.com.au/2017/03/tax-cuts-stronger-investment,-higher-wages,-more-jobs.

Swan, Wayne. 2016. The Hawke-Keating agenda was Laborism, not neoliberalism, and is still a guiding light. The Guardian [cited 11th June 2017]. Available from https://www.theguardian.com/commentisfree/2017/may/14/the-hawke-keating-agenda-was-laborism-not-neoliberalism-and-is-still-a-guiding-light.

Tietze, Tad, and Elizabeth Humphrys. 2015. Anti-politics and the Illusions of Neoliberalism. Oxford Left Review (14), http://oxfordleftreview.com/olr-issue-14/tad-tietze-and-elizabeth-hymphreys-anti-politics-and-the-illusions-of-neoliberalism/.

Turnbull, Malcolm. 2017. Address To The National Press Club. Prime Minister Of Australia The Hon Malcolm Turnbull Mp [cited 27th Feburary 2017]. Available from https://www.pm.gov.au/media/2017-02-01/address-national-press-club.

World Bank Group. 2017. Global Economic Prospects, June 2017: A Fragile Recovery. Washington, DC:: World Bank.

Žižek, Slavoj. 2000. The Fragile Absolute - or, Why the Christian legacy is worth fighting for. London & New York: Verso.

[i] In editing this piece Ali questioned this argument and suggested that in the long-term a rise in wages would raise aggregate effect demand and if accompanied by state investment may technically solve capital’s problems. I’m uncomfortable about making firm predictions about hypothetical futures and suspect that there is a larger debate here about the interrelationship of profit and/or demand and investment (with Marx vs Keynes hiding in the background) and the desirability or possibility of a radical reform program in the transition out of capitalism.

Speaking hypothetically, I suspect that a simple rise in wages which is not off-set by either an increase in productivity, lengthening of the working day or an increase in the intensity of work would just add further pressure on the rate of surplus-value and thus the rate of profit even if it could possibly expand the size of the market and perhaps the mass of profit. I remain generally convinced that it is the rate of profit today and the expectations of its size tomorrow that is the major determining factor in the location and size of capital investment.

More concretely I think that since investment in Australia is already low any further reductions in profits would only intensify this in the short-term and thus cancel out any long-term. I also think that the capacity for state investment is considerably restricted by rising state debt.

However, as Ben has pointed out to me Australia faces the current strange situation of a spike in profits yet continual dwindling investment – this may be because the profit rise was due to an unexpected rise in the prices of export commodities (Silk 2017).

[ii] The point is that all things being equal this is true. There is a considerable debate about given the complex reality of actual existing capitalism how much impact corporate tax cuts have on investment when considered alongside other factors. For the mainstream debate see (Jericho 2017b, Kouparitsas, Prihardini, and Beames 2016, Minifie 2017, Smith-Gander 2017)

[iii] In editing this piece Ali made the point that the two different strategies of the Government and the Opposition may both hinge on productivity as the driver of wage increases but have vastly different implications for the working class. The Government’s general approach is about the reducing the power of labour in relation to capital whilst the Opposition’s focus on training and job creation could increase labour’s bargaining power. Like endnote i above I think this touches on the question of the relationship to reforms in the here and now to the accumulation of our power. But more than this it asks us to think what the relationship is between class self-activity and the dynamics of capital accumulation… and the ability of policy to impact the latter.

My general position is that I don’t think policy right now can do much, that there isn’t a social democratic option possible within the present coordinates of capital accumulation. More than this I think the general role of Australian Laborism has been historically to tie labour to capital and deepen our subordination. The ALP today still looks back to the Hawke-Keating government as its model (Swan 2016). And it was the Accord delivered by the Hawke-Keating government and the Trade Unions which broke the cycle of struggles of the Fordist period and facilitated the implementation of neo-liberalism (Humphrys 2015).

Comments

Read this again - a good read

Read this again - a good read and highlights the similarities in mainstream political and economic arguments around capitals problem with 'productivity' that appear in the media here in the UK as well.

Haven't read it yet, but I

Haven't read it yet, but I like the image.