Aufheben analyse the causes and nature of the credit crunch and subsequent financial crisis.

Introduction

On September 12th 2008, before the assembled grand financiers of Wall Street, Hank Paulson, flanked by his team from the US Treasury, announced his determination that there would be no government money to bail out Lehman Brothers, the fourth biggest investment bank in the world, which was on the verge of going bust. After two days of frantic negotiation and brinkmanship the grand financiers called Paulson’s bluff and Lehman Brothers was obliged to file for bankruptcy.

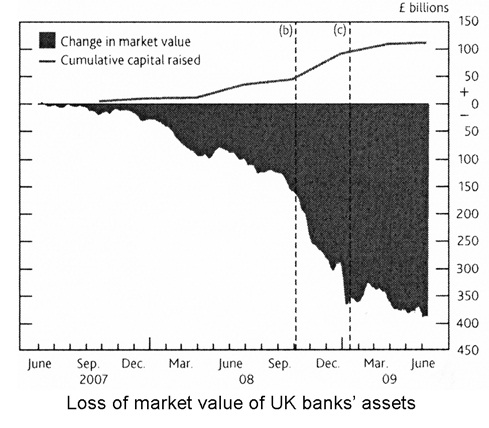

The financial crisis that had begun a year earlier with the credit crunch was now brought to a head as panic spread through the markets. For the next four weeks the global financial system teetered on the verge of meltdown as government and monetary authorities struggled to avert an economic catastrophe. The US Congress was brow-beaten into conceding a huge $750 billion government bail out of the financial system. In Britain New Labour was obliged to surpass old Labour’s 1983 manifesto pledge by nationalising two of Britain’s largest banks.1

The culmination of the financial crisis accelerated the slow-down in the real economy. Despite substantial attempts to reflate the economy by expansive monetary and fiscal policies across the world, there were very real fears over the following few months that there could be a global depression on a scale not seen since the 1930s.

So what is the nature and significance of the current financial and economic crisis? What implications does it have for the future of capitalism?

Only a few months ago it was being widely proclaimed that the near meltdown of the global financial system had sounded the death knell for the era of neo-liberal capitalism. With the election of Barack Obama, the way was open for a new ‘green Keynesianism’ that would once again cage the monster of finance and establish a more progressive and egalitarian capitalism. Others saw the crisis as marking the beginning of the end of American hegemony. For them, the crisis could only accelerate the shift of economic power from the US to Asia. A few even suggested the possibility that the crisis could mark the end of capitalism itself.

A year on from the collapse of Lehman Brothers, with the return of the ‘bonus culture’ and business as usual in the main financial centres of the world, and the rest of the bourgeoisie increasingly confident that economic recovery is well on its way, all such excited claims that the crisis has marked a decisive historical turning point now seem a little too premature if not rather ridiculous.

To comprehend the significance of the current financial and economic crisis it is necessary to understand its nature and causes. We need a theory of the crisis. Where are we to find it? Should we not look to Marx?

Certainly the crisis itself has dealt a severe blow against market fundamentalism and in doing so has brought to the fore those critical of the prevailing economic orthodoxy. It, at least momentarily, appeared to vindicate the numerous Cassandras, whether from the political left or the right, who had repeated warned over the last three decades that the financial de-regulation and the debt fuelled economic boom would inevitably end in tears. But in doing so the crisis has also brought into focus the inadequacies of such critical theories, particularly those derived from Marx.

In perusing the various Marxist theories of crisis that have been trundled out to explain the current crisis, what is evident is how outdated most of them are. Despite a few minor adaptations to explain developments over the few decades, most are essentially little different from the crisis theories developed in the 1970s.

At that time the main enemy had been the then prevailing Keynesian orthodoxy that had claimed that modern capitalism had overcome the evils of boom and bust through the tight regulation of finance capital. Against this it was argued that capitalism as a whole was an inherently crisis-ridden system. What is more, it was argued that capitalism was in decline and, as a result, it was becoming increasingly mired in stagnation. Attempts to use Keynesian style fiscal and monetary policy to stimulate the capitalist economy in order to overcome stagnation and postpone the inevitable crisis had only served introduce ever greater amounts of inflation in the system.

The adoption of neo-liberal economic policies to restructure capitalism in the 1980s was widely recognised by Marxists as demonstrating the failure of the old Keynesian orthodoxy. However, it was usually insisted that neo-liberalism would prove no more effective in avoiding stagnation and crisis than the old Keynesian orthodoxy had been. Now, it was asserted, with the re-emergence of finance capital, capitalism could only be kept going, not so much by inflation but by ever-greater asset bubbles and ever growing amounts of debt. Sooner or later there would be a big economic crash.

The failure to accept the efficacy of neo-liberalism in reviving capitalism, and the crucial role resurgent finance capital has played in this, has meant that it has not been the capitalist economy that has stagnated but much of Marxist crisis theory. As the crisis, which it was insisted was always just around the corner, failed to arrive, Marxist theory has increasingly retreated into methodology.2 Most of those who still claimed to be inspired by Marx turned away from the issues of crisis and the functioning of the capitalist economy.

The diminishing number that steadfastly predicted the big crash over the last twenty or thirty years can now feel at long last vindicated. They have been enthusiastically joined by many Marxist intellectuals, and would be intellectuals, who have now discovered that Capital was not merely a critique, but a critique of political economy; that Marx was not just a pupil of Hegel but was also a student of Ricardo. But the failure to adequately explain the long economic upturn of the last twenty years makes their theories of the crisis decidedly hollow.

There has arisen a gap between the abstract formulations derived from the study of the crises of the 1970s and the concrete specificities of the current crisis.3 At best this has meant having to adopt quite uncritically concepts from bourgeois economic theory.4 But all too often this gap has been covered up by a descent into a crass empiricism where ever-greater numbers are quoted as supposedly statistical evidence to prove the severity of the situation without any regard for what these numbers actually mean.5 Instead of concrete analysis we have a profusion of buzzwords and clever Marxoid phrases such as ‘fictitious capital’ or ‘financialisation’, which obscure more than they explain.

In part II of this article, which we will publish in the next issue once the dust has settled a little more, we shall seek to understand the nature and historical significance of the current financial and economic crisis for global capitalism. To do this it will be necessary to critically consider in far more detail the various theories put forward to explain the underlying causes of the crisis. We shall look at the various theories put forward by Left Keynesians and see how they fail to explain the social and economic crisis that lead to the demise of the old Keynesian orthodoxy and the rise of neo-liberalism. We shall then look at stagnationist theories put forward by various strands of Marxists, and see how they are unable to explain the long economic upswing of the past two decades. And we shall consider the theories of a rising profit rate put forward by Permanent Revolution, and ourselves in pervious issues,6 and see how it overlooked the importance of global finance in realising and distributing surplus value across the world.

As a prelude to this we shall here in Part I present a basic account of the crisis and its immediate causes. In doing so we shall be concerned with immediate appearances as they present themselves to the bourgeois mind in order grasp the specifities of the current crisis. Of course, this does not mean studying the rarefied theories of bourgeois economics, but with relating and translating the perceptions of those who are practically concerned with the everyday functioning of the capitalist system. The perceptions of central bankers, financial commentators and pundits have been coloured by the ideology of market fundamentalism, and by the economic

models which purport to give it intellectual credence, but they are not simply deluded. As their willingness to countenance unorthodox emergency measures in the current crisis shows, they are ultimately quite pragmatic. After all immediate appearances are not illusions but real.

We shall begin by going back early 2007 and the eve of the current crisis.

An account of the crisis and its immediate causes

The calm before the storm

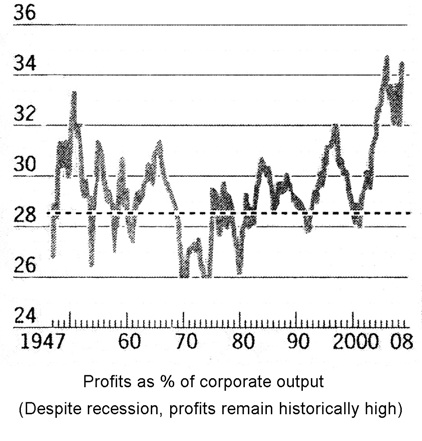

In early 2007 the masters of the universe, the plutocrats, their ministers and their minions could feel more or less content with the world. Whatever problems there may be with rogue and failed states and terrorism, the economic fundamentals of the global capitalist system seemed sound. The global capitalist economy seemed to be in fine fettle. Profits were high, as were bonuses and the rewards of office. The world economy was expanding at a brisk 6% per annum. In the advanced capitalist economies of North America and western Europe inflation, the great bane of previous decades, had now been long subdued; while, unemployment rates were stable if not falling.

What is more, class conflict, if not entirely eliminated, was no longer the threat it had once been. There was, it was true, growing working class militancy in China and other parts of Asia; and of course the working class in Western Europe remained entrenched and resistant to the march of neoliberalism. But such problems were challenges that the bourgeoisie could feel confident could be contained, if not eventually resolved.

Little less than seven years earlier the outlook had seemed decidedly different. The wild speculation in the shares of newly emerging information technology companies, which had seen firms often employing a few dozen people, and making little or no profits, being given stock market valuations greater than that of major transnational corporations, had come to an abrupt halt, resulting in what became known as the dot.com crash. At the beginning of March 2000 the Nasdaq composite price index of IT company shares had peaked at $5048.62. It then suffered a series of sharp falls. The Nasdaq was to fall by.more than 70%. More than $5 trillion was wiped off the market value of dot.com shares.

At the time there had been serious concerns that the dot.com crash could trigger a collapse in other financial markets, leading to a financial crisis on a scale not seen since that of 1929 – and hence the possibility of a major economic recession. For the critics of the neoliberal bourgeois consensus, particularly those that gave voice to the anti-globalisation movement, it appeared, at least briefly, that the day of reckoning for neoliberalism and global capitalism may have arrived. By deregulating financial markets and tearing down the barriers to the free movement of capital neoliberal policies had created the monster of global finance capital. Only recently, it could be argued, the recklessness of this monster had wreaked havoc on the populations of Latin America, East Asia and Russia in a series of financial crises at the end of the 1990s. Now it seemed it was coming home and about to turn on its creators.

However, such concerns soon abated as the financial system proved that it was sufficiently resilient to absorb the shock of the dot.com crash. Nevertheless this crash burst the bubble of hype that had surrounded the dot.com boom. All the exaggerated talk, about how the emergence of the ‘new weightless economy’ had so transformed capitalism and that the boom could go on more or less for ever, had evaporated. With the dot.com crash, the banks pulled the plug on the myriad of IT start up companies that had been generously bankrolled in the hope they might prove to be ‘the next Google or Microsoft’. Larger and more established companies in the ‘new economy’ now found it far harder to raise capital to finance expansion and had to cut back on planned investment. The consequent sharp contraction in the ‘new economy’ then had a knock on effect on the economy as a whole. Companies in the ‘old economy’ that had made good profits directly or indirectly supplying goods or services to either IT companies themselves, or else their often highly paid employees, now felt the pinch. As a result the dot.com crash brought about a sharp slowing of economic growth for the US economy as whole.

Those more sober policy makers and commentators who had long warned that the 1990s debt-fuelled boom could not last forever, and that it would inevitably be followed by a period of economic retrenchment, in which businesses and individuals alike would need to cut back on spending to reduce the high levels of debt they had accumulated during the ‘good-times’, now seemed to have been vindicated. The prospect of a severe and possibly prolonged recession had begun to loom.

As it turned out, the subsequent economic recession of 2001-2002, which affected not only the US but much of the world, proved to be mild and short lived, certainly when compared with the recessions of the early 1980s or the early 1990s.

Credit for averting such a severe and prolonged recession is usually given to Alan Greenspan, the then chairman of the US Federal Reserve Board, for taking prompt and decisive action to ‘ease monetary’ policy as soon as it became clear that the dot.com boom was resulting in a slowdown in the US economy. From the beginning of 2001 Greenspan began pushing through a series of half and quarter per cent cuts in the official interest rates. As a result, by June 2002 the official Federal Reserve Funds rate, which had been 6.5% in 2000, had been reduced to 1% - a rate that had not been seen for nearly fifty years. Other major central banks followed suit, bring down interest rates across the world.

Lower interest rates certainly came to the rescue of many firms who, having borrowed heavily on the expectation of continued economic growth, now found themselves struggling to meet their debt obligations in the face of falling demand and declining revenues. As such Greenspan’s bold and determined reduction in interest rates served to avert an avalanche of bankruptcies that could have only deepened and prolonged the recession.

Furthermore, by making it easier and cheaper to borrow money Greenspan’s cut in interest rates served to give a timely boost to the debt-fuelled growth of consumer demand. Lower interest rates meant that individual households could afford to supplement their current incomes by extending their overdrafts or by taking out larger personal loans. Yet such means of borrowing was limited by the reluctance of banks and other financial institutions to lend to individual households without some form of security against possible default. For the vast majority the only substantial asset they could offer as security was their homes.

The easing of monetary policy also made it easier for homebuyers to take out larger mortgages. But, with the supply of housing limited, this extra money in the pockets of competing home buyers simply meant that house prices were bid ever upwards. However, rising house prices meant that it was easier for existing homeowners to borrow by taking out second mortgages, offering as security the increased value of their homes - or ‘property’ as homes increasingly came to be known.

This ‘release of housing equity’ was an essential part of the success of Greenspan’s easing of monetary policy in sustaining the growth of consumer demand that helped ameliorate the depth and duration of the post-dot.com recession. Yet, as many of his critics have pointed out, much of the effectiveness of Greenspan’s easy money policy in ameliorating the 2001 recession depended in a large part on ever-rising house prices. As we shall see, the resulting prolonged bubble in house prices was to have particular significance in the longer term.

Perhaps just as important as the easing of monetary policy in reducing the depth and duration of the 2001 recession, was the substantial fiscal stimulus provided by the Bush administration in his first term as president. Promises to make substantial tax cuts had been a central part of Bush junior’s election campaign. On taking office at the beginning of 2001 Bush was able to use the looming fears of recession to overcome the opposition of fiscal conservatives in his own party in Congress to push through a series of substantial tax breaks targeted mainly at the rich.

At the same time, the time limited legislative restrictions designed to limit ‘pork barrel’ government spending, which had been introduced ten years before in order to reduce the huge government budget deficits built up under Ronald Reagan’s presidency, were allowed to lapse. Bush junior was thereby able to give generous hand outs to his many business friends. Then, in addition to this surge in ‘pork barrel’ spending, came the unexpected escalation in military spending caused by the wars in the Middle East and the occupations of Iraq and Afghanistan.

With tax revenues falling and government spending rising the US government’s financial position moved sharply in to the red. In Clinton’s last year of office there had been a budget surplus that amounted to more than 2% of annual GDP of the US economy. By the end of Bush junior’s first term in office this had become a budget deficit amounting to 4% of annual GDP. This growing deficit meant that the government was pumping more money and demand into the economy than was being clawed back through taxes. The growing government deficit, along with the growth in consumer demand caused by the easing of monetary policy, served to offset the fall in demand generated by investment spending. Towards the end of Bush junior’s first term the economy had not only come out of recession but was beginning to pick up speed.

Even so there were still some concerns amongst both economic policy makers and their critics that the recovery might not be sustainable. Much of the US economy was still in a phase of retrenchment. Many firms were still concentrating on cutting costs to restore profits. Rather than using these restored profits to invest in expansion, many firms were still paying off their debts or even accumulating substantial ‘cash’ surpluses. For much of the American economy capital accumulation remained stalled and, as such, the economic recovery was still dependent on ever increasing consumer and government borrowing. Clearly in the long term economic growth could not be sustained on the basis of ever increasing government and consumer debt.

However, such concerns had also soon dissipated. By the time of Bush junior’s re-election as US president it was beginning to become clear that the engine of capital accumulation had at long last begun to kick in as the rate of investment began to increase. Capital accumulation could now begin to take over from government and consumer spending in propelling economic growth. As tax revenues consequently increased and economic growth picked up, the budget deficit stabilised and began to fall as a proportion of annual GDP. In the summer of 2004 Greenspan had felt able to begin to steadily tighten monetary policy in order to rein in the debt-fuelled growth in consumer demand and gradually deflate the housing bubble. By early 2007 the budget deficit had fallen to 2.2% of annual GDP while official interest rates had been restored to 5.25%.

Viewed seven years later, the dot.com crash, far from demonstrating its fragility, could be seen as providing a further example of the global financial system’s resilience and robustness. The dot.com boom had once again shown how financial markets were prone to wild irrational exuberance leading to booms and sudden crashes. But it had also demonstrated how, so long as monetary authorities were vigilant and acted promptly and decisively, it was possible to limit the impact on the real economy. Indeed, as Alan Greenspan argued, even if it was possible for the monetary authorities to prevent asset price bubbles in the financial markets, it would not be desirable since such irrational exuberance played an essential part in the dynamism of capitalism.

Hence, with hindsight, the dot.com crash and the subsequent recession of 2001-2002, could be seen as little more than a minor correction in what had now become a fifteen year-long economic upswing that had followed the tumultuous years of crisis, class conflict and economic restructuring of the 1970s and 1980s. What was more, with the US-led recovery this upswing had seemed to be taking on a broader and more stable character than it had in the 1990s. Indeed, by early 2007, the long economic upswing was becoming known as ‘The Great Moderation’: a period of steady economic growth, low inflation and ever greater financial stability. It was argued by many bourgeois commentators that we had entered a new age of economic prosperity that was well on the way to surpassing that of the long post-war boom of the 1950s and 1960s.

As such neoliberal ideologues could claim to have been vindicated. The hard and often unpopular neoliberal policies that had seen the defeat of organised labour, the privatisation and commercialisation of state provision of public services, the tearing down of impediments to the free movement of capital and the embracing of a globalised capitalism, could now be seen to have well and truly borne fruit. They were now able to concede to their critics in the anti-globalisation movement that neoliberal policies might have at times made the rich richer at the expense of the poor, particularly in the third world. They could admit that the free movement of capital may have burdened third world countries with unacceptable debt that had been borne disproportionately by the poorest sections of their populations. They could readily admit that global finance had brought about boom and bust with devastating consequences to the working populations of Asia and Latin America. However, for them all this had for the most part been the necessary birth-pangs for a new, dynamic, born again free-market capitalism.

Freed from the ‘artificial’ impediments, which had been imposed by organised labour and nationalistic states during much of the twentieth century, this new globalised capitalism was now not only making the rich richer but, by converting peasants into wage labourers, was lifting hundreds of millions of people out of abject poverty. In addition increased economic prosperity was creating a substantial ‘middle class’ in many ‘third world’ countries - but particularly in China and India - that could enjoy a standard of living and consumer lifestyle that had previously been largely confined to North America, Japan and Europe.

As a consequence, the more adept neo-liberal ideologues could now turn the tables on their critics in and around the anti-globalisation movement by trumping their moralistic concerns for the poor of the ‘third world’. Many in the anti-globalisation movement held a certain nostalgia for the golden age of Keynesianism of the 1950s and 1960s when finance, free markets and the free movement of capital had been highly circumscribed by nation states. It could be readily admitted that such arrangements had promoted economic growth and prosperity. But it could be pointed out that such growth and prosperity had been largely confined to the long established capitalist countries of North America and Europe. Absolute poverty may have been more or less eradicated in the west, but improvements in the living standards of the vast majority of the world’s population had been limited. Furthermore, the only country of any size to have joined the club of rich nations during this period had been Japan. ‘Globalisation’ was now serving to spread the benefits of capitalism across the globe. Now there were a host of nations knocking on the door of the rich nations’ club and, according to the IMF’s calculations, 60% of world economic growth was accounted for by ‘newly emerging market economies’.

So, in early 2007 the view from the citadels of capitalist power looked bright. Of course there were some ominous dark clouds on the horizon. There were the growing concerns over the depletion of the world’s oil reserves and the need to reduce oil dependency. There was the issue of climate change and the problems of moving to low carbon economy. There was also the problem of the continuing international trade imbalances and problems of financing the US growing foreign debts.

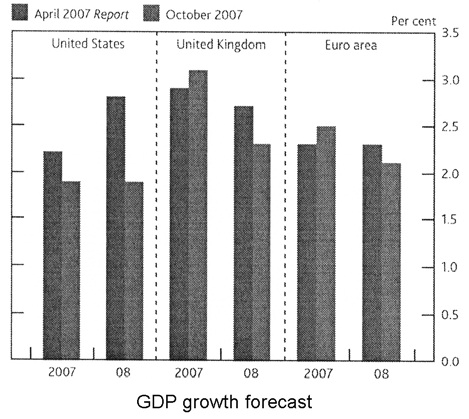

However, all these problems still lay in the future. In the short term worries on the part of economic policy advisors that rising prices of oil and raw materials might lead to inflation had by early 2007 given way to worries that such price rises combined with the tightening of monetary policy was leading to a mild economic slow down. But such worries were minor, and certainly paled into insignificance compared with the problems economic policy makers had faced a generation before. Indeed many argued that a mild slowdown in the US economy would not be such a bad thing since it would provide the economic slack for the American economy to move towards a more balanced investment and export-led growth that would allow it to begin unwinding its debts.

Although many economists expected a mild slowdown in the US economy, few if any predicted that the financial system would come close to a meltdown and as a result the US and indeed the world would only narrowly avoid a full scale economic depression. Yet already early in 2007 events were rapidly unfolding that were to lead to the credit crunch that summer.

Bubble, bubble, toil and trouble

From resilience to fragility

It is now well known that the difficulties in the US sub-prime mortgage market that had begun to become apparent in early 2007 were to turn out to be the trigger that detonated the current financial crisis, which subsequently broke out with the credit crunch in the summer of 2007 and then culminated little more than a year later with the collapse of Lehman Brothers and the near meltdown of the entire global financial system. How was it possible that such difficulties, in what after all had up until then been a rather small and obscure sector of the US mortgage market, were capable of having such a devastating effect both on the global financial system and the world economy?

The now widely accepted explanation of how this came about can be set out as follows. After more than three decades of deregulation the financial markets across the world had by the beginning of this decade become more or less self-regulating. This process of deregulation had of course been based on the neoliberal nostrum that, so long as they were open and transparent in their operations, financial institutions were best left to pursue their own self-interests. After all, it was argued, each financial institution was best placed to make a rational assessment of the balance between the prospects of making a profit and the risks of making a loss from any deal it might make with any other player in the financial system. Any financial institution that was behaving recklessly and taking too many risks would soon lose its reputation and hence lose business once its financial position became widely known. As such well-informed rational calculations regarding both the promise of profit and threat of bankruptcy were seen as being normally sufficient to ensure that this pursuit of self-interest by each financial institution promoted both the efficiency and the stability of the financial system as a whole.

Mainstream economists had done their bit in giving a scientific gloss to such neoliberal nostrums by publishing volumes of treatises giving ‘rigorous mathematical proofs’ of this supposed ‘market efficiency hypothesis’. Of course, however much they may have been committed to ‘free market fundamentalism’, those who had practical responsibilities in supervising the financial markets knew that in fact reality did not always correspond to the abstract formulations of conventional economic theory. As we have already mentioned, Alan Greenspan had readily admitted that financial markets were prone to bouts of ‘irrational exuberance’, which became evident in the speculative asset price bubbles. If these bubbles were allowed to go too far then when they burst they could trigger an avalanche of bankruptcies that could seriously destabilise the financial system as a whole.

In the more regulated past central bankers had seen it as part of their responsibilities to nip these bubbles in the bud - or, as William MCChesney Martin (Chairman of the Federal Reserve Board between 1951 and 1970) put it, central bankers had to ‘take away the punch bowl before the party got going’. However, many of the policy instruments that allowed central bankers to intervene to prevent asset bubbles going too far had been dismantled as part of the process of deregulation. The principal means with which central bankers now had to curb speculative asset bubbles were either to resort to exhortation or to increase official interest rates. In Greenspan’s opinion neither means had much efficacy. Carefully worded statements from respected central bankers could have a significant effect on market sentiments but were unlikely to be sufficient to reverse a speculative stampede once it had got going. If exhortation was too weak, then raising interest rates was perhaps both far too strong and too weak a weapon to curb speculative bubbles. Raising interest rates sufficiently high to break the momentum of speculation in the financial markets risked having a serious impact on the real economy. Indeed, for Greenspan the prime purpose of interest rate policy was to control price and wage inflation, not to regulate the financial system.

As a consequence, Greenspan had concluded that there was little option but to let speculative bubbles to run their course. When they eventually came to an end then the financial authorities would then have to be prepared to intervene promptly and decisively to contain the impact of the bursting of the bubble. Some financial institutions may have to be allowed to go bust, and if nothing else this would provide a salutary lesson to others of the consequences of wild speculation for the future. However, the authorities would have to be prepared to act to prevent any avalanche of bankruptcies that could threaten the financial system as a whole. The central banks might have to act as the lender of last resort in order to supply much needed liquidity to the financial system as a whole; they might also have to cut interest rates, while those financial institutions, particularly the major banks, deemed too big or important to fail might have to be bailed out. If central bankers could no longer take away the punch bowl before the party got going then it would have to act as the emergency services that could bury the dead and take care of sick when the party was over.

Alan Greenspan could be quite sanguine about this doctrine of benign neglect regarding financial bubbles and speculation. As the dot.com crash seemed to confirm, the growing size and sophistication of the global financial system meant that it was resilient enough to absorb the impact of the bursting of even major asset bubbles with minimum help from the financial authorities. The financial authorities were rarely likely to be called to bail out the financial system in a big way. As such Greenspan could claim that the costs of the financial authorities in providing this guarantee to the stability of the financial system was likely to be far less than the benefits gained from free self-regulating financial markets. If he had been more conversant with Hegel he may have said that the ‘irrational exuberance’ was merely a necessary moment of the rationality and efficiency of the financial system.

Thus when Greenspan began cutting interest rates in 2002 he acted strictly in accordance with his doctrine. For Greenspan, interest rates had to be cut to exceptionally low levels in order to ward off the threat that the slowdown in the real economy would lead to a downward spiral of prices and wages. He was not particularly worried by its impact on the financial markets. Yet, as his critics from both the left and right have argued, in cutting official interest rates to exceptionally low levels, and then holding them there for an extended period of time, Greenspan can be seen to have created the conditions of cheap money and easy credit that triggered an increasingly reckless over-expansion of the financial system.

On past experience, by making it easy and cheap for speculators to borrow money, low interest rates could have been expected to have fuelled speculative bubbles in financial exchanges; such as the stock exchanges, the foreign currency exchanges or the various ‘commodity’ markets. It is true that share prices had tended to rise; as did the prices in most of the major ‘commodity’ markets.7 But these price rises were relatively steady and could be seen to be broadly in step with the global economic recovery. Rising share prices more or less reflected the rise in corporate profits; while rising ‘commodity’ prices could be seen to reflect the fact that growth in world demand for raw materials and agricultural products was outstripping their supply. There was little sign that such prices rises were due to any excessive ‘irrational exuberance’.

Nevertheless, low interest rates can be seen to have contributed to the acceleration of the trend towards the rapid expansion, greater complexity and integration of the global financial system. Exceptionally low interest rates squeezed the profit margins that could be made from simply lending money. To compensate for this squeeze on profit margins financial firms were driven to respond in three ways. Firstly they could find new ways of expanding the volume of loans (a financial version of pile them high, sell them cheap). Secondly they could make loans that were considered to be more risky on which they could charge a higher interest rate – known as the ‘search for yield’. Thirdly, and perhaps most importantly, they could shift away from making their money from interest payments and instead concentrate on the revenues that could be derived from various fees and commissions they could charge for carrying out large money transactions.

By far the most important drivers of this tendency towards the rapid expansion, greater complexity and integration of the global financial system were the commercial banks. The principal function of commercial banking is to collect deposits from those businesses and individuals that have, at any moment, idle money and then to lend this money to those businesses and individuals that have need of money. As such commercial – or high street – banks play an essential role for any modern capitalist economy. Also, by collecting together a large proportion of the real economy’s savings through their extensive network of high street branches, commercial banks have control over vast sums of money that make them major players in the financial system. Because of the importance of commercial banking both to the real economy and the financial system, at least the major commercial banks are considered as being too big to fail. In the past, as a quid pro quo for providing the tacit guarantee that they would bail them out if they got into trouble, the financial authorities had insisted on tightly regulating and supervising the activities of commercial banks. Now, however, unhindered by such regulation and supervision, but still confident that they would be bailed out if the worse came to the worse, commercial banks were able to respond to the pressure placed on their profit margins by low interest rates by embarking on an aggressive, and what was to prove an increasingly reckless, expansion.

Taking advantage of their access to the vast pools of savings, commercial banks now became increasingly embroiled in the complex web of international finance, becoming involved in activities that had previously been the preserve of the investment banks. The investment arms of the commercial banks now began competing with the investment banks in producing and marketing various increasingly ‘sophisticated and innovative’ financial instruments. We can distinguish two broad types of such financial instruments that were to play an important part in undermining the stability of the financial system; firstly there were those instruments that were designed to manage risk, and secondly there were those involved in the ‘securitisation of debt’.

The basic purpose of those instruments designed to manage risk was to provide companies, both in the real economy and in the financial sector with a means to insure themselves against unexpected adverse financial or economic events or a combination of events. Amongst other benefits by buying these instruments companies could reduce the amount of idle money-capital they needed to hold in reserve to cushion themselves against any losses resulting from such unexpected events.

These instruments are essentially analogous to bets on certain economic or financial outcomes. By betting on an outcome that might have a substantial adverse effect on their business a company could limit its potential losses if it actually occurred. The role of the investment bank is like that of the bookmaker, taking bets on various outcomes by selling various financial instruments and paying out if such events occurred. Like a bookmaker, an investment banker will seek to cover what has to be paid out if a particular event actually occurs with the money received on the bets that this event will not occur – taking a small cut of course for running the book.8

As a consequence, to the extent that companies are risk-adverse and in effect seek to make bets with long odds (i.e. they pay a small amount to insure themselves against unlikely but high costly events), then the investment bankers have to find those prepared to in effect make the corresponding opposite short odd bets. This opened up a lucrative opportunity for financial firms, such as the notorious hedge funds, in betting against unlikely economic and financial events. With the growing competition in investment banking caused by the encroachment of the investment arms of the commercial banks, and in the prevailing climate of declining economic and financial volatility, it was tempting for investment bankers themselves to follow the hedge funds into this area of business. This could be done either directly, by not fully covering the instruments with ‘long odds’, or by lending money to hedge funds so they could ‘leverage up’ their investments. As a result, investment banks and the investment banking arms of the commercial banks became heavily exposed to the possibility of large losses if the financial and economic situation became more volatile and uncertain.

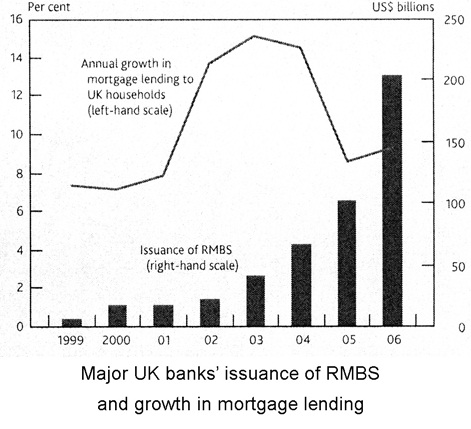

The second broad type of financial instrument that we need to highlight are those involved in the various forms ‘securitisation of debt’. Traditionally banks made loans to businesses and individuals and then held them until they were fully repaid. With the ‘securitisation of debt’ banks make loans and then bundle similar types of loans together and sell the rights to the interest and repayments of the loans in the form of tradable securities. As such, banks do not make their money on the interest on the loans but on the fees and commissions that are earned for originating and managing the loans.

The advantage for banks is that by selling off their loans they can then use the proceeds of such sales to make further loans and thereby make more money in the form of fees and commissions. Furthermore, because the risk that there might be exceptionally high defaults on these loans is transferred to the buyers of the debt, banks do not need to hold money reserves in order to cover the losses that may arise. Yet at the same time, in taking the form of tradable securities, these loans can be sold on to third parties by their buyers. Because they can be easily converted into money these assets appear as liquid assets that can be used instead of money as part of their owners’ reserves against losses on other business dealings.

Indeed, as was to become exposed in the current financial crisis, the securitisation of debt performs a great conjuring trick in which illiquid loans are magically transformed into highly liquid assets that persuade everyone involved that they need fewer reserves to cover unexpected losses.

We shall return to this in more detail later when we consider the crucial role of the securitisation of mortgage debt in bringing about the 2007 credit crunch. However, we must now draw together the implications of the trend towards the rapid expansion, greater complexity and integration of the global financial system that can be seen to have been accelerated by Greenspan’s interest rate cuts.

Firstly, the increased integration of the global financial system meant not only a growing interconnectivity across national boundaries but also a blurring of the old divisions between different financial functions. The old firewalls, such as those which had separated commercial banking from investment banking, and investment banking for hedge fund activities, or which had separated the financial system from one country from that of another, were eroded. As a result, the global financial system had become far more susceptible to the rapid spread of crisis from one part to another.

Secondly, the growth in the sheer complexity of financial deals made the global financial system increasingly opaque, not only to those entrusted with supervising the system but also to those directly involved. With many financial instruments often based on dense and intricate specifications and sophisticated mathematical models, few if anyone were able to fully understand. Deals had to be made largely on trust and the reputation of those involved, rather than on ‘due diligence’ before entering such deals. Thirdly, as we have seen in the case of the ‘securitisation of debt’, many of the financial innovations and developments had served to reduce the amount of cash reserves necessary to cushion the system from unexpected shocks. As a result, rapid expansion prompted by exceptionally low interest rates could be seen with hindsight to have left the global financial system dangerously over-extended.

As a result of all this it can be argued that the global financial system had by 2007 become increasingly fragile. As such it would need only a relatively small unexpected shock to bring down the house of cards. The shock proved to be the crisis in the US sub-prime mortgage market.

The housing boom...

The boom in US house prices had begun as early as 2000 – well before Alan Greenspan had begun cutting interest rates. Of course, house price booms are far from being anything new, and, at least at first, this boom seemed to exhibit all the familiar dynamics as previous ones had done. Periods in which house prices rise faster than the general levels of wages and prices, and in which market transactions become increasingly frantic as people seek to ‘get on the housing ladder’ before it becomes unaffordable, have always tended to alternate with periods in which house prices and the housing market are stagnant. Indeed, it can be said that the capitalist production of housing as a commodity necessarily gives rise to housing booms and busts. Why is this?

Normally capitalistically produced commodities will tend to sell at their prices of production, that is the cost of production plus the general rate of profit ruling in the economy as a whole. If excess demand arises the market price will rise. This will lead to higher than average profits in the industry producing the commodity. These higher profits will then in turn attract an inflow of capital into the industry concerned providing the means to expand the production and hence the supply of the commodity. Supply will then rise to meet the increased demand and the market price will to price of production. Thus constantly rising prices can only be the result of systematically increasing costs of production or of demand continuing to increase faster than supply.

However, there are certain peculiarities of the production and sale of houses that alter the operation of this normal process of regulating both prices and the relation of supply and demand. First of all, on the side of supply, there is the fact that houses take a considerable time to build. The time taken from the decision to build, through the various planning procedures, the securing and preparing of the building site, to the actual completion of the construction of new housing is measured in months if not in years. Thus compared for example to most manufactured commodities, even small incremental increases in the supply of housing can take considerable amounts of time to come through. As a result the market prices can for considerable periods rise above the price of production as supply takes time to catch up; and equally, if supply overshoots demand, market prices may well fall for a considerable time below the price of production.

The second, and perhaps more important, peculiarity of the construction of housing is that land is an essential and substantial factor of production. For capital to be invested in the construction of new housing land had to be bought. By using the scarcity of land, landowners can use the increase in demand for land to raise land prices. The increase in market price for housing thereby leads in time to an increase in the price of land and hence the costs of production facing the house builder. This means that the supply of new housing for sale will depend as much on the rate of increase in house prices as their actual level, since house prices have to out run the consequent rise in land prices.

On the demand side there is a third peculiarity that arises from the substantial cost of housing. The price of a house is usually several times the annual income of any likely buyer. Few homebuyers are in a position to simply buy a house outright. Instead they have to take out a loan using the house itself as security in case they are at some point unable to meet the repayments, that is they have to take out a mortgage. This means the price a homebuyer can pay for a house is not determined by the amount of money they have in their pocket, but how much they can borrow. However, the amount they can borrow depends on what is deemed by the mortgage lender to be the market price of the house that is the security for the mortgage loan. As a consequence, in a situation where there is even a small shortage of housing at the current market price, there can arise a prolonged upward spiral in house prices. As the market price of houses is bid up, mortgage lenders are prepared to lend more money, which then allows homebuyers to bid up prices further, and so on.9

Yet there is a further twist in this upward dynamic of house prices that drives a housing boom. This upward spiral of house prices depends on both the willingness and ability of mortgage lenders to provide mortgage loans. Of course, mortgage lenders are willing to make loans because they are able to make money in doing so. Yet this prospect of making a profit has to be weighed against the possibility that those they lend to may default on the loan, and the subsequent losses this may incur for the mortgage lender. Mortgage lenders will therefore seek to ration the mortgage funds they lend to those least likely to default.

The obvious means of rationing mortgages is to set restrictive criteria of creditworthiness for potential borrowers. Those who have shown themselves to have bad credit records in the past, it can be reasoned, are likely to have a higher risk of defaulting in the future. Another important method of rationing loans is to lend only a certain proportion of the full market price of the house that is to be mortgaged. The difference between the amount loaned on the mortgage and the purchase price of the house is then expected to made-up out of the pocket of the homebuyer. In this case it may be reasoned that if the home buyer is able to manage his finances sufficiently to save up the amount needed to make this ‘down payment’ or ‘deposit’ on the house, then they are likely to be sufficiently financially competent to be able to keep up with the subsequent mortgage repayments.

The willingness of the mortgage lenders to lend only a certain proportion of the market price of a house not only serves to restrict mortgage lending to those least likely to default, it also serves to minimise the losses that might be incurred if a default does occur. After all, if the mortgage lender only lends say 70% or 80% of the full market price, in the unlikely eventuality that the homebuyer does default on the mortgage, and the house has to be repossessed and sold off, then, even with the considerable legal costs of repossession proceedings and the substantial discount on the market price that may have to be accepted for a quick sale, the mortgage lender can be confident of recovering the money still owed on the mortgage.

However, far more importantly, the amount mortgage lenders can lend also depends on the funds they have at their disposal. They may impose highly restrictive criteria for assessing creditworthiness and insist on large ‘deposits’, not merely to minimize the costs of defaults, but to limit the demand for mortgages to the available supply of mortgage finance available. This is important if we are to understand the cycle of boom and bust in the housing market.

In the wake of a recession, when money is still tight, and when rising unemployment has led to increasing mortgage defaults, mortgage lenders will be reluctant, if not unable, to expand the supply of mortgages. As a consequence, mortgage lending will restrictive and both the number of mortgages and amount loaned on each one will be strictly rationed. Even when economic recovery leads to falling unemployment, rising wages and to more stable economic conditions, and consequently to an increase in the numbers of potential home buyers, mortgage restrictions, particularly the need to find a substantial deposit, will serve as a break on any incipient house price spiral.

However, to the extent that economic recovery brings about an expansion in the funds available to finance mortgage lending, competition will drive mortgage lenders to become less restrictive. In order to find outlets for the funds at their disposal they will have to compete to attract potential homebuyers. They may relax the criteria they use in assessing their creditworthiness. Alternatively, in what often amounts to the same thing, they may produce ‘innovative’ mortgage repayment schemes ‘tailored’ to the financial circumstances of the homebuyer. But most importantly they can increase the proportion of market price they will loan. Whereas mortgage lenders may have insisted on offering only 70% or 80% mortgages; 90%, 95% and even 100% mortgages start to become common. Once this competitive process takes hold the breaks come off the house price spiral and the housing boom takes off.

Of course, with rising house prices and with people stretching their finances in desperation to buy a home of their own, there is the danger that mortgage lenders, in their drive to expand their mortgage book, will at some rather indeterminate point begin to lend ‘too much’ and as a result face sharply rising default rates. However, because defaults usually occur long after a mortgage is granted no one can be certain when this point has been reached.

Nevertheless, mortgage lenders can still see themselves as acting prudently because even if there is a sharp rise in defaults, due to the aggressive expansion of mortgage lending, rising house prices will limit any losses incurred. After all, even if a mortgage lender offers a 100% mortgage, by the time the homeowner defaults and the house is repossessed, house prices will have risen far enough that sale of the house, even if it has to auctioned at discount, will be sufficient to pay any legal costs and allow most if not all of the money lent to be recovered.

Indeed, if house prices are rising, and are expected to continue to rise, then mortgage lenders will feel less restrained by the fear that expanding lending might lead to a significant rise in future defaults on their loans. With rising house prices minimizing the costs of any particular default, the increased profits that can be made by lending more is likely to far outweigh any increase in losses caused by the rise of the number of defaults.

However, the emergence of a mortgage industry dominated by long established and relatively large mortgage lenders has long served as a check to competitive pressures towards predatory lending. Of course, as is often observed, few mortgage lenders, particular well-known high street banks and building societies that are dependent on doing business with the general public, will want to risk being seen as loan sharks; ensnaring people in loans they can’t repay and then ruthlessly evicting them from their homes. They will therefore be careful that their rate of repossessions does not rise too high, particularly in comparison with their main competitors.

Although reputation for responsible lending has played its part, perhaps a far more important restraint on the competitive pressure to relax lending restrictions has been the need to find the vast sums of loanable capital required to fund large scale mortgage lending. Mortgage lenders have been able to attract cheap loanable capital on a large scale because mortgage lending is seen as a very safe investment that produces predictable and reliable returns. Even if a mortgage lender can expect to recover most of its losses due to mortgage defaults, the process of foreclosing the loan, repossessing the house and then selling it takes time. During this time the repayments on the defaulted mortgage have stopped. It is only when the house is sold and the money raised is lent out again, so that the defaulted mortgage is replaced by a new performing one, that repayments recommence. High or volatile default rates can therefore lead to large variations in returns on the money invested on mortgage lending, as defaults disrupt repayment flows. They may also introduce a degree of uncertainty that may undermine the perception of the mortgage lender as being involved in an almost risk free form of investment.

Certainly, in previous housing booms competitive pressure have produced a progressive relaxation of lending restrictions and a reduction in deposits. They may have also seen at times the emergence of cowboy operators engaged in predatory lending for short-term profit. However, by and large, most mortgage lenders have long enough time horizons and resources to have been able to resist the competitive pressures, and indeed temptations, to go very far beyond the limits of responsible lending. Certainly since the second world war mortgage default rates have remained very low, and have been usually the result of unforeseen changes in circumstances of the borrower; such as illness, unemployment or divorce, rather than due to any predatory lending. This is true even after the housing booms have burst, and the full extent of excess lending is likely to have been revealed.

However, previous house price booms had usually been cut short by economic crises or recessions. What came to distinguish the 2000-2007 housing boom from previous housing booms was its duration. Although the cut in interest rates to exceptionally low levels in 2002 may not have been the original cause of the housing boom, it certainly can be argued that it helped to prolong it. Firstly interest rate cuts can be seen to have mitigated the post dot-com recession that may have otherwise brought the housing boom to an abrupt halt. Secondly, to the extent that they obliged banks to compensate low profit margins by expanding their lending, including mortgages, exceptionally low interest rates gave a timely boost to the availability of mortgage finance necessary to sustain the housing boom.

As it continued, there were growing concerns on how much longer the housing boom could go on, and what might happen when it ended. Had boom and bust in the housing market been replaced by a semi-permanent boom? Would it soon end in a big bang? Or could it be gently deflated?

Of course, even the most enthusiastic estate agent could not claim that the house price boom could continue forever – even if there was a limitless supply of mortgage funding. It had to be admitted that, although the amount that can be paid for a house is immediately limited by the amount that can be borrowed, ultimately what can be borrowed depends how much loan repayments a homebuyer can afford to pay. As house prices rose, and mortgage debts became ever larger, it could be argued that eventually some ill-defined point would be reached where homebuyers would not be able to afford to meet the required loan repayments. At that point the house price boom would necessarily have to come to an end.

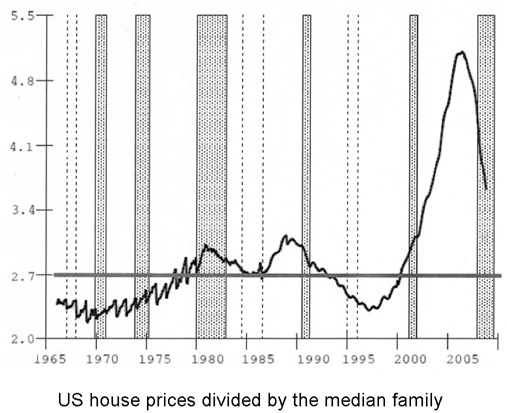

The question then was whether the American housing boom had reached, or even overshot, this point. Certainly, with house prices outpacing wages for the best part of a decade, by 2007 the ratio of the average house price to the average annual wage had reached unprecedented heights. But this did not mean that the housing boom had reached the limits of affordability. If nothing else, to the extent that they had been cut short by recession and rising unemployment, then previous housing booms were not necessarily a good guide to the limits of how much mortgage debt was ultimately affordable.

But even if it was the case that previous booms had come close to reaching the limits of affordability, and that would have soon run out of steam anyway, then this would not mean that the current limits of mortgage debt were the same as what they had been then. Firstly, it could be argued, that with the steady growth in the numbers of women working and having their own careers in recent decades then, in the case of working couples, affordability had now to be judged on joint incomes rather than that of the average male wage. Secondly, most of the recent and comparable housing booms had taken place during periods of high inflation when, consequently, interest rates had been very much higher than they were even before the interest rate cuts that began in 2002. With less interest to pay, homebuyers could afford to take out larger mortgages and pay a higher price for their home. Indeed, the average ratio of mortgage repayments of homeowners to their total household income in the US, even as late as 2006, did not seem exceptionally high by either historical or international standards.10

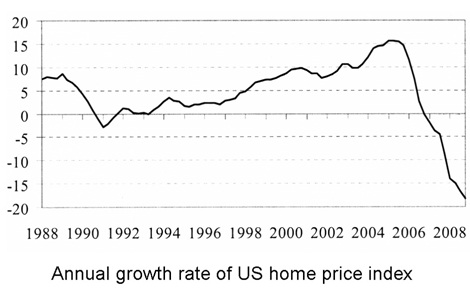

From its early stages there had been repeated predictions that the housing boom was about to come to a sticky end. The failure of these repeated predictions had only served to convince many, particularly those in the mortgage industry, that, although the boom might not be able to go on forever, it still had a long way to go before house prices became unaffordable. However, during 2006 it became increasingly clear that the boom was slowing down. The rate of increase in house price slowed sharply. By the end of the year the average price of a house had already peaked and there were signs that US house prices in general were beginning to fall.

This slow down was largely attributed to the impact of Greenspan’s decision to raise interest rates a year or so before. Certainly, the substantial increase in interest rates had meant a considerable increase in mortgage repayments that prospective homebuyers faced on any particular size of mortgage. With house prices less affordable many prospective homebuyers might put off buying a house, thereby reducing demand. Nevertheless, many commentators had still thought that this impact of higher interest rates might prove to be temporary. Once prospective homebuyers adjusted their expectations as to what mortgage repayments were needed to buy a house then the chronic shortage of housing would force them to start bidding up the price of housing again. The upward spiral of house prices would then be restored. Others suggested that once expectation of ever-rising house prices was shattered the dynamics of the house price boom would be thrown into reverse. Banks would restrict lending and house prices would tumble, perhaps by 20%, 30% or even more. The third position, which was based on the experience of previous housing booms, was that house prices might to what they were a year or so before and then stagnate. With sellers reluctant to sell their houses for less than they had paid for them they would withdraw from the market. The housing market would then largely seize up until wage inflation allowed wages to catch up with house prices.

Yet even if house prices tumbled, or the housing market stagnated for an extended period, this would not in itself produce dire consequences. So long as house owners had the means to repay their mortgages it did not matter how far actual house prices fell. The fall in the demand for housing would certainly have an impact on the housing industry and other industries dependent on the housing market. There may be problems with labour mobility as workers found the sale of their home was no longer sufficient to pay off the mortgage and they had become trapped by ‘negative equity’ and could not move house. Furthermore, many mortgage lenders would be given a hard economic lesson in the need to maintain lending standards as the costs of defaults rose sharply. But none of this meant the end of the world or some serious economic or financial crisis. After all, as past experience had repeatedly shown, the cycle of boom and bust in the housing market was an effect of economic and financial crises and the business cycle rather than a cause of them.

Critics of the prevalent sanguine view of the US economy had long pointed out the growth of consumer debt, particularly mortgage debt, as the ticking time bomb that would sooner or later blow apart American-led economic prosperity. It could be suggested that the substantial rise in interest rates could have tipped millions of American homebuyers down the slippery slope of mortgage arrears, eventually leading to debt default. It could be argued that even though there was ample evidence to show that the average mortgage borrower was not in fact that heavily indebted, this was in fact a little misleading. After all this was an average that obscured the fact that there could be a large proportion of homebuyers whose financial position was very far from being the average.

Even the individual homebuyer could expect to have a distinct cycle of mortgage indebtedness. As a first time buyer, most homebuyers are obliged to stretch their finances to get on the property ladder. At that point in their life mortgage payments are likely to be a large proportion of their income. However, even if their wages only rise in line with everyone else’s, the burden of mortgage repayments, which at any given rate of interest normally remain fixed in money terms, will tend to fall. Wage inflation will continue to erode the homebuyers’ mortgage debt until they decide to move to a larger house and therefore take out a larger mortgage, or take out a second mortgage on the existing house to finance increased expenditure. Mortgage repayments will then rise again as a proportion of income before once again being eroded by inflation. Eventually, when the family leaves home, the house buyer may trade down to a smaller house. Then whatever mortgage repayments remain will be small, if not negligible.

As a consequence, at any time there may be a considerable proportion of homebuyers, particularly those who have just bought their first home, that are close to the limits of their ability to keep up their mortgage repayments. An unexpected rise in interest rates could therefore place a substantial number of homeowners in serious difficulties. Furthermore, the housing boom had occurred during a period of low inflation. Therefore mortgage debt erosion would have been slower which, together with the large increase in people taking out second mortgages, would seem to suggest that there could be far more homeowners at risk from the jacking up of interest rates than would have been the case in previous housing booms that had occurred during periods of high inflation.

Against this view it could be argued that interest rates had not been suddenly raised from 1% to over 5% all at once. Alan Greenspan had made evidently clear that his intention was to raise interest rates and had done so in gradual steps giving lenders and borrowers considerable notice of which way things were going. What is more, because most American mortgages are based on ‘fixed rates’ in which interest rates are only adjusted every two or three years, most people would have had plenty of time to adjust to the rise in rates. Undoubtedly there would be considerable numbers of home buyers who had taken out mortgages expecting low interest rates to continue and these could face serious financial difficulties. But most households would go to considerable lengths to prevent the roof over their heads being taken away. By working extra overtime, taking up an extra job, or else cutting back on other expenditures, most of the households in financial difficulties due to the unexpected rise in interest rates could be counted on to keep up their mortgage payments.

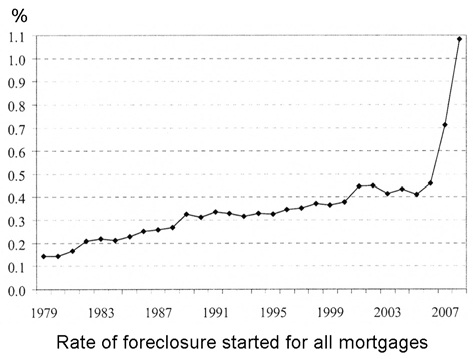

Certainly it was true that by the beginning of 2007, even though levels of employment in the American economy still remained largely stable, the number of mortgage defaults had already risen to levels that were high by historical standards. Nevertheless, those who took the sanguine view could take comfort from looking across the Atlantic. The UK, Ireland and Spain had all experienced very similar booms to that which had occurred in the USA. Indeed, in some cases, the housing boom in the UK had started much earlier and had seen house prices rise much further than in the US. Yet, although variable interest rate mortgages were much more common in the UK, which meant that the impact of the rise in interest rates on homebuyers had been far more sudden than it had in the US, their had been no tsunami of mortgage defaults. What is more, as Alan Greenspan pointed out at the time, in the UK the rate of house price increases had slowed down for a while but there were already strong indications that the housing market was beginning to take off once more.

Alan Greenspan was perhaps correct in counting on the rationality and responsibility of mortgage lenders and homebuyers in the traditional mortgage market to limit the excess lending and borrowing of the long housing boom to manageable levels. But, with hindsight, we now know that the likes of Greenspan had seriously underestimated the significance of once small corner of the US housing market that had come to circumvent many of the traditional checks and balances on excess lending and borrowing. This was the sub-prime market.

... and the sub-prime bust

In their efforts to shift the blame from the greed of bankers and the failure of free market capitalism, some right-wing Republicans in the US have argued that the ultimate cause of the current financial crisis was the well-meaning, but ill-judged attempts on the part of liberal Democrats to distort market mechanisms in order to expand home ownership to the feckless poor.

It is true, as they point out, that the origins of what was to become known as the sub-prime mortgage market can be traced back to the Community Reinvestment Act (1979) and Depository Institutions Deregulation Act (1980) passed under the Carter administration in the late 1970s. In order to correct what was seen as the implicitly racist lending practices of mortgage lenders, to renovate poor and depressed neighbourhoods and to facilitate the emergence of a black middle class, the Carter administration had sought to extend homeownership to poor and disadvantaged minorities. Under these acts mortgage lenders were to be permitted, and indeed encouraged, to offer a new type of mortgage that would be exempt from the usual regulations governing standard mortgages. This distinct new type of mortgage would allow those who would have been rejected from taking out a standard mortgage loan due to a poor credit or employment history to borrow in order to buy a house. In return for accepting the higher risk of such sub-prime mortgages, mortgage lenders, together with certain government guarantees and inducements, were to be allowed to charge a higher rate of interest on the these sub-prime loans.11

The Reagan administration, with its ideology of market deregulation and a property-owning popular capitalism, was far from being adverse to efforts to expand homeownership. As right-wing Republicans usually gloss over, far from reversing Carter’s ‘affirmative action’ with regard to mortgage lending, Reagan’s administration sought to consolidate and extend it with measures included in the Alternative Mortgage Transaction Act (1982) and the Tax Reform Act of (1986). With these acts the parameters of what was to become the sub-prime mortgage market were firmly established. However, the expansion of the sub-prime mortgage market remained limited. It was not until the Clinton administration that a further concerted attempt was made to expand homeownership to the poor and disadvantaged minorities.

In 1989 hundreds of savings and loans institutions, the American equivalent to the old British building societies, went bust. These usually mutually owned institutions had provided a proportion of mortgage lending to working class homebuyers. This savings and loans crisis, combined with the perennial problem of what to do about the decay of America’s inner cities, had pushed the issue of housing up the political agenda in the 1990s. In coming into office Clinton had sought to find a ‘third way’ solution to the problem that would allow him to outflank the Republicans, and, at a time when the government deficit was dangerously high, would not cost the public purse too much money. As such public provision of social housing or direct housing subsidies were out of the question. Instead, the market was to be harnessed to achieve social ends. To do this Clinton sought to use the profit-making mortgage lenders to provide the finance to sustain and expand homeownership.

Firstly, the Clinton administration used its regulatory powers to cajole mortgage lenders into providing mortgages to disadvantaged minorities and deprived neighbourhoods. Under the Community Reinvestment Act (CRA), mortgage lenders had been given a rating by the regulatory authorities that indicated how well they were doing in diversifying homeownership across different groups in society. This CRA rating was now to be taken into account when regulators decided whether to grant permission for mortgage lenders to expand their financial activities, set up new branches and merge with other institutions. This meant that it was in the interests of profit-making mortgage lenders to pursue the social objective of expanding homeownership to disadvantaged groups.

Secondly, the Clinton administration permitted the two ‘government sponsored’ corporations, Freddie Mac and Fanny Mae, to buy up sub-prime mortgages from mortgage lenders. As we shall see in more detail later, Freddie Mac and Fanny Mae had long played a major role in reducing the risks faced by mortgage lenders by buying up their mortgages and then selling them on to financial markets. However, in providing what amounted to an insurance against default losses, Freddie Mac and Fanny Mae and been restricted to buying up mortgages that had been granted following strict procedures to ensure the homebuyer could be expected to be willing and able to keep up the necessary repayments. By allowing Freddie Mac and Fanny Mae to buy up more risky mortgages, the Clinton administration could hope to entice mainstream mortgage lenders to become more involved in sub-prime lending.

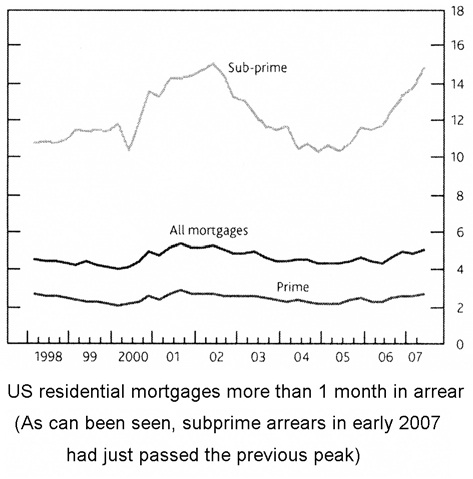

The promotion of sub-prime mortgages contributed to a rapid expansion and diversification of homeownership in the 1990s.12 As a result, from being a rather specialist financial activity, sub-prime mortgages now became a significant segment of the mainstream mortgage market. By the year 2000 sub-prime mortgages accounted for 5% of all outstanding mortgages in the USA. Yet the reckless boom in sub-prime lending that was to lead to the sub-prime crisis began not under Clinton but towards the end of Bush junior’s first term of office.

As we have seen, exceptionally low interest rates had put considerable pressure on banks and other financial firms to compensate for low profit margins on each of their loans by expanding the amount lent, by making money from money dealing in the form of brokerage fees and commissions involved in various financial transactions, and by searching for investments that gave a higher return. The vast American mortgage market offered substantial potential business opportunities to make money in these ways.

No longer content to simply buy up the mortgage debt offered by Freddie Mac or Fanny Mae, the big investment banks now began to ‘cut out the middleman’ and buy up mortgages directly from mortgage lenders. Their lobbyists launched a campaign against the two government-sponsored mortgage institutions. It was claimed that because they were implicitly backed by the government they could borrow money cheaper and had an unfair advantage. Although their attempts to gain congressional support for imposing stricter limits on the activities of Freddie Mac and Fanny Mae failed, they succeeded in forestalling any political and regulatory scrutiny on their own activities by presenting the investment banks as the injured party. Together Freddie Mac and Fanny Mae had purchased 90% of all mortgages sold on the ‘secondary mortgage market’; by 2007 it had fallen to less than 50%.

The sub-prime segment of the American mortgage market was particularly attractive to the investment banks because it offered significantly higher returns for what seemed very little extra risk. As a consequence, there was a high demand on the part of investment banks and other financial firms for sub-prime mortgages. With sub-prime mortgages easy and profitable to sell on to other investment banks, mortgage lenders responded by increasing the supply by issuing more. The growth of sub-prime mortgage lending rose far faster than standard mortgages. By 2007 14% of all outstanding mortgages were sub-prime.

As could be expected, competitive pressures to expand mortgage loans led to a relaxation of lending restrictions. This was all the more so for sub-prime mortgages, which were expected to be a bit more risky anyway. With house prices rising, and expected to continue to rise, and with it easy and quick to sell on mortgages, mortgage lenders had little incentive to maintain rigorous lending practices. As competition increased to find ever more borrowers to satisfy the voracious demands of the investment banks for sub-prime mortgages, the more unscrupulous mortgage lenders became ever more reckless. To entice people to take out a sub-prime mortgage they offered especially low interest or repayment terms for the first two or three years. These low payments being rolled-up to be paid in later years when it was hoped the borrower’s financial position might have improved. At the extreme, some mortgage lenders even made what were later to become known as NINJA loans; that is they granted mortgage loans to people who had no income, no job or no assets.

With house prices rising, mortgage lenders were confident that after two or three years the price of the house that was mortgaged on these terms would have risen sufficiently to allow the borrower to take out a bigger loan to pay off any arrears. Failing that the house could always be repossessed and the loan recovered.

But all this depended on ever rising house prices. As we have seen, by 2006 the rise in the average price of houses in the USA had slowed down and had begun to slowly fall. This was, however, an average price. Sub-prime mortgages were highly concentrated in deprived and rundown neighbourhoods. As the low repayment periods began to run out on loans made in 2004, sub-prime mortgage defaults had begun to rise sharply. As a consequence, mortgage lenders began to repossess increasing numbers of houses and auction them off. But this flood of housing coming on to the market drove down the price of housing in these neighbourhoods. Indeed, house prices in many of these neighbourhoods began to collapse. As a result, sub-prime mortgage lenders now began to find that they were unable to sell the houses they were repossessing and were left holding increasingly derelict buildings. In the coming months neighbourhoods across the USA were turned into little more than ghost towns as homelessness soared.

Increasingly unable to recover their loans, and with the number of defaults rising rapidly, mortgage default losses soared. By early 2007 3% of the $2.3 trillion sub-prime and other non-conventional mortgages had defaulted. But to the extent that these mortgages had been sold on, these soaring default losses did not simply hit the mortgage lenders; they struck the investment banks and the various financial firms that had ended up owning these mortgages.

As we have seen, the financial system had become increasingly fragile. It was these default losses that proved sufficient to bring the entire house down.

Who saw it coming?

Of course, with hindsight we now know that these sub-prime default losses were leading to the credit crunch of the summer of 2007 and the subsequent unfolding of the financial crisis a year later. But it was certainly not evident that this was going to happen at the time.

Alan Greenspan was certainly aware of the developing sub-prime mortgage crisis in early 2007. However, he could rightly point out that mortgage default losses, which were then running in tens of billions of dollars, was still relatively small beer. After all, the annual GDP of the US was $15 trillion.